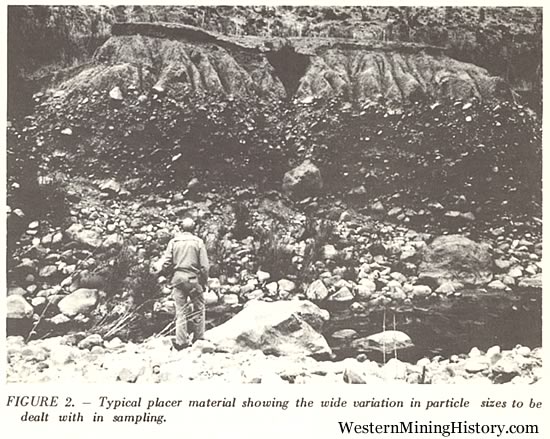

If the reader will pause and study Figure 2, he can better visualize the more pertinent placer sampling problems, as they are taken up in the following paragraphs.

1. GENERAL CONSIDERATIONS

a. Problems: Contrary to popular belief, representative placer samples are seldom easy to obtain and in almost all cases sample results need a large measure of interpretation. Some of the underlying reasons are:

-

(1) Large particle sizes to be dealt with. A representative sample should contain all of the constituents of a deposit and in exactly the same proportion in which they occur in the parent mass. But look at Figure 2. This deposit is a mixture of fine sand, pebbles and boulders varying from a few tens of pounds to hundreds of pounds, and in this respect, is typical of many placers. A little study of Figure 2 will show why when dealing with such deposits, it is virtually impossible to take a small sample representative of the whole mass, and why the evaluation of such a deposit can tax the ability of an expert.

- (2) High unit-value of gold. When dealing with the typical placer sample containing a high-value mineral such as gold, any error in mineral content of the sample will be highly magnified in the end result. Consider that in a commercial placer the relative amount of gold (by volume) may be on the order of one part gold to a hundred-million parts of gravel. To the mineral examiner this means that a single fly speck of gold in a pan of gravel is equivalent to say, 2 to 5 cents per cubic yard, depending on the exact size of the speck. The actual separation of small amounts of such gold from overwhelming quantities of sand and gravel seldom presents a serious problem; the real problem is to take a sample that is representative in the first place.

-

(3) Erratic distribution of values. Obtaining a satisfactory placer sample would be a comparatively simple undertaking if the valuable minerals were uniformly distributed throught the whole mass. In almost all placers, however, the heavy minerals and particularly the gold are more or less segregated. For example, in cases where economic values are confined to pay streaks, these are likely to occur as narrow, discontinuous accumulations with perhaps little or no value in between. Where coarse gold is present it can be expected to be even more erratic in distribution and it should be evident that under such conditions reliable valuation will depend on something more than taking a few small samples and an exercise in arithmetic. In theory, these problems can be overcome by taking samples large enough to offset the eccentricities of a deposit, but to do so, would mean taking samples measured in tons rather than pounds and it is seldom possible to take such large samples in actual practice.

Some approach the problem by arguing that if enough small samples are taken, the highs will balance the lows and the end figure will represent the average value of the deposit even though no one sample is correct. This may be statistically true but here again, practical considerations seldom permit taking the number of samples needed to achieve this end.

b. Industry practice: How do the established placer mining companies evaluate their prospects? First, the prospecting is put in charge of an employee who has had wide experience with the type of deposit or mining project involved. Second, they recognize that anyone sample is rarely representative of the overall deposit and by itself may mean little. Third, after studying the combined prospecting data and perhaps taking special check samples, experience-based adjustments known as "correction factors" are applied to the initial sample data where needed and, finally, the calculated values are based on these "adjusted" data. Here, it should be emphasized that the successful placer companies place as much reliance on the experience and insight of their prospecting and management personnel as they do on the sample results. If there is a mathematical formula or a general rule which will replace experience-based judgement, the operating companies have not found it.

c. Minerals other than gold: Parenthetically, it should be noted that placers chiefly valuable for minerals such as monazite, rutile, cassiterite, ilmenite, etc., are generally easier to sample and evaluate than gold placers. There are several reasons. First, the valuable mineral makes up a larger part of the mass. Second, the mineral sought has a relatively low unit value which means that extraneous particles of such mineral (in a sample) may have little effect on the calculated value. Third, deposits containing such minerals are often made up of well sorted, small-size detrital materials such as beach sands and, in such cases, the mechanics of sampling may be simplified by permitting the use of augers or jet drills in lieu of churn drills. Speaking generally, the sampler has considerably more latitude when dealing with minerals of low unit-value than when dealing with gold and his mistakes are less likely to seriously affect the end results.

d. Other factors to be considered: Many things other than mineral content have a direct bearing on the commercial value of a placer deposit. The mineral value in itself may be of secondary concern where sampling or examination of the lands for example, show unfavorable bedrock conditions, excessive amounts of sticky clay, large boulders or other factors that would adversely affect a placer mining operation. A good sampling program will provide the information needed to evaluate adverse physical conditions, should they exist, but here again experience is needed to interpret the information and make correct decisions.

e. In brief: Placer samples yield limited information. Correct interpretation of this information depends upon the engineer's powers of deduction and experienced judgement, rather than on the rigid application of formulae.