Heritage Auctions is the world’s largest auction house for collectibles, including many of the incredible gold ingots that have been salvaged from the wreckage of the S.S. Central America. This article presents some of the most valuable ingots to sell at auction, and includes fascinating historical background on the private assay firms that created the ingots in the 1850s.

The majority of the text on this page came from historical descriptions that were included in various listings at Heritage Auctions.

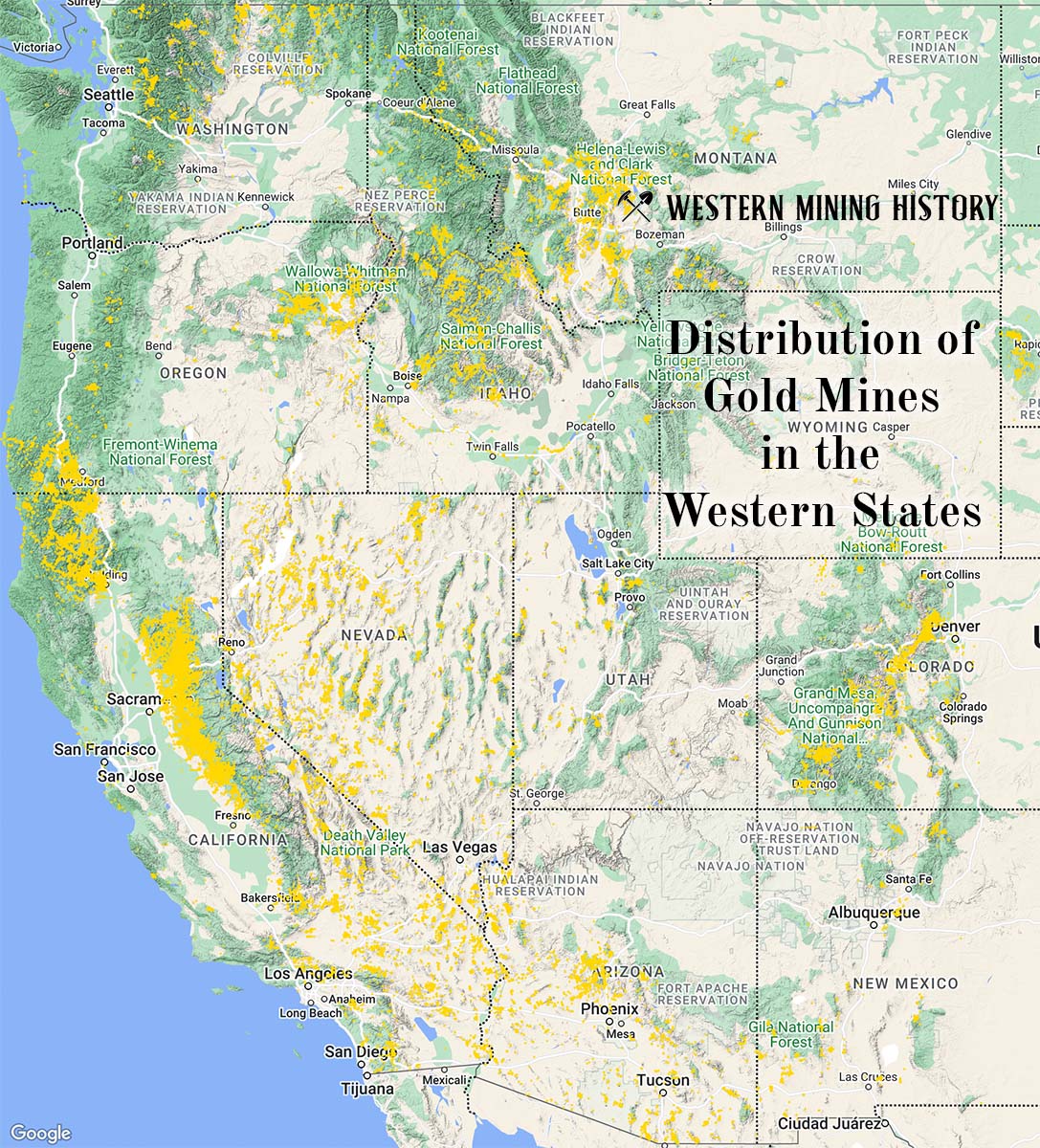

The discovery of gold in northern California in January 1848 was a transformative event for California itself, the nation, and the people who participated in the “rush” to settle there.

Before the discovery California was a sparsely populated outpost in northern Mexico. After John Marshall’s discovery it became a major contributor to the U.S. economy. The influx into the American economy of so much California gold had the effect of increasing the value of silver (an effect that would be corrected after the discovery of the Comstock Lode).

The Gold Rush spawned a significant western migration by Europeans and Americans on the East Coast. The Gold Rush also caused the city of San Francisco to use gold dust as an awkward means of conducting commercial transactions. The fineness of gold dust varied from one location to another, and it was often adulterated with flakes of brass and thus its value varied widely.

Soon the citizens of San Francisco were clamoring for a branch mint. Their pleas for standardized coinage were finally answered with the establishment of the San Francisco Mint in 1854, but even then, the mint could not keep up with the needs of the conversion of placer gold into coins or ingots of varying sizes and weights.

Into this void stepped a dozen or so private assayers, firms with impeccable reputations who could convert gold dust into stamped ingots, some within 24 hours.

Assayers’ ingots were accepted as a medium of trade, and as the bars recovered from the S.S. Central America demonstrate they were particularly popular and useful for the transfer of large amounts of wealth.

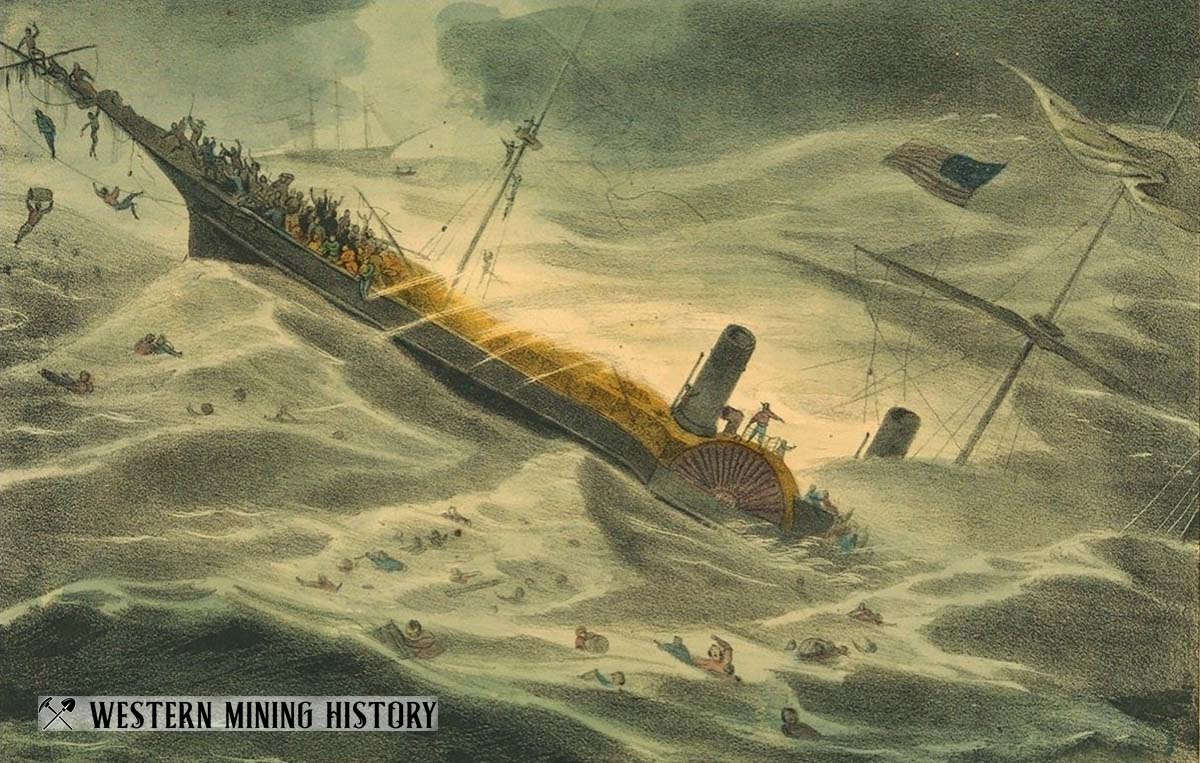

Sinking of the S.S. Central America

Much of gold that were being recovered from the goldfields of California during the 1850s was shipped to eastern banks along the same arduous route that many of the gold seekers originally took to travel to California–from San Francisco to Panama by ship, then fifty miles overland across the Isthmus of Panama, then again by ship to the East Coast of the United States.

By 1855, the Panama Railroad was complete, facilitating the bulk transfer of cargo across the isthmus, including large quantities of gold from California. On September 3, 1857, The S.S Central America, laden with ten tons of gold, and carrying 477 passengers and 101 crew, left the City of Aspinwall, now the Panamanian port of Colón, sailing for New York City.

On September 9th, the ship became engulfed in a hurricane, its sails were shredded, water infiltrated the boiler room causing the ship to lose power, and the resultant loss of the bilge pumps spelled doom for the S.S. Central America and its crew. In what was called the greatest American navigation disaster up to that time, the ship was lost along with a combined 425 crew members and passengers.

The gold that was lost in the wreckage was worth over $800 million at current gold prices of around $2,000 an ounce. This staggering loss of wealth set off a financial panic that strained the economies of both the United States and Europe.

With a unimaginable fortune sitting at the bottom of the sea, it was inevitable that advances in technology would eventually entice adventurers to go after the treasure, which sat at a depth of 7,200 feet below the surface. Finally in September of 1988, the Columbus-America Discovery Group sent the first expedition to sunken treasure ship–the successful operation recovered an estimated $100-$150 million in gold. In subsequent years, several more expeditions recovered additional gold and other treasures.

The following are just a selection of the incredible ingots from five prominent California private assay firms that were salvaged from the S.S. Central America, and sold at auction in recent years. Included is historical background information from these firms in text that appeared within various listings from Heritage Auctions.

Justh & Hunter

The scale of the Justh & Hunter operation was not fully understood until 85 of their gold ingots were brought up from the first round of S.S. Central America recovery efforts during the late 1980s through the 1990s. The total value of those bars in 1857 dollars was $232,328.86 — the equivalent of more than $7 million in 2021.

Of the five firms represented in the Central America treasure, Justh & Hunter had the second highest number of gold ingots, more by far than the third most represented assayer, Harris, Marchand & Co.

Emanuel Justh was a lithographer in Verboca, Hungary. He emigrated to San Francisco from Hamburg, Germany, making the trip in 159 days with only one stop in Valparaiso, Chile. Justh established a lithography business in San Francisco and continued in that line of work throughout 1854. In the early months of that year he learned the assaying business and was in the employ of the U.S. Branch Mint.

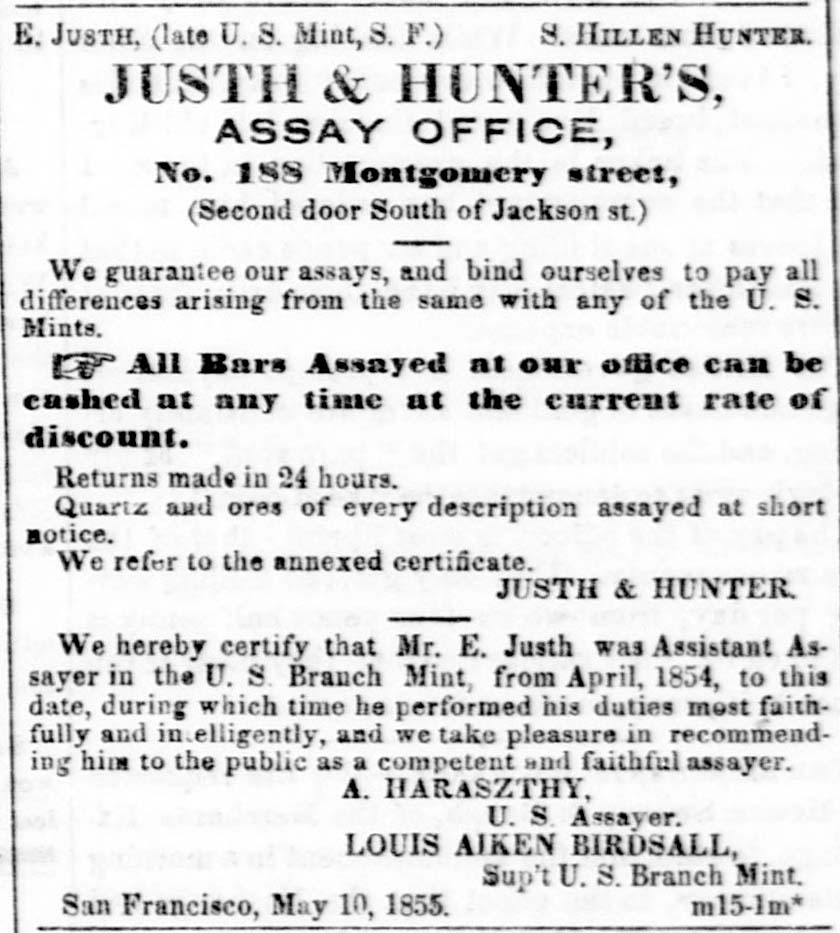

Merely one year later, in May 1855, Justh established an assaying partnership with Solomon Hillen Hunter. Justh’s departure from the branch mint was apparently an amicable one since the new assaying partnership received the recommendation of U.S. Assayer, Agoston Haraszthy (a fellow Hungarian émigré), and branch mint Superintendent Louis Birdsall. These two mint officials heartily endorsed Justh’s relatively newfound abilities, stating ” … we take pleasure in recommending him to the Public, as a competent and faithful Assayer.”

Solomon Hunter came to San Francisco from Maryland, where he had been in the shipping trade in Baltimore. In a curious twist of fate, he arrived in California on the S.S. George Law. That ship was later renamed (but not sufficiently refurbished) as the S.S. Central America, which, of course, was eventually responsible for bringing the importance of his firm to the attention of the numismatic community about 130 years later.

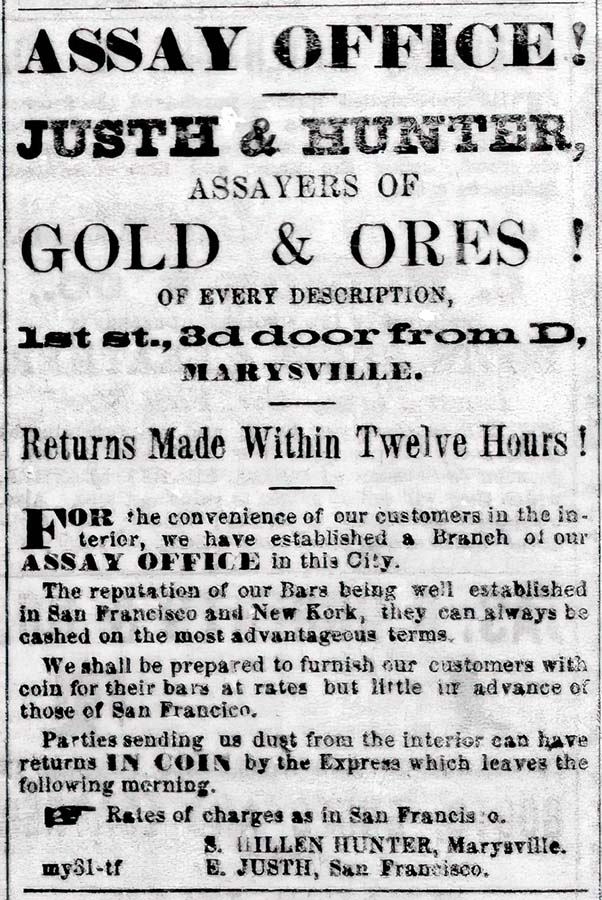

Events moved quickly for the partnership and by May 1856 Justh & Hunter had opened a branch assay office in Marysville, significantly closer to the gold fields. The men promised a 12-hour turnaround on ore they assayed in that office. The firm of Justh & Hunter remained an important California assayer until the two principals dissolved their partnership in July 1858.

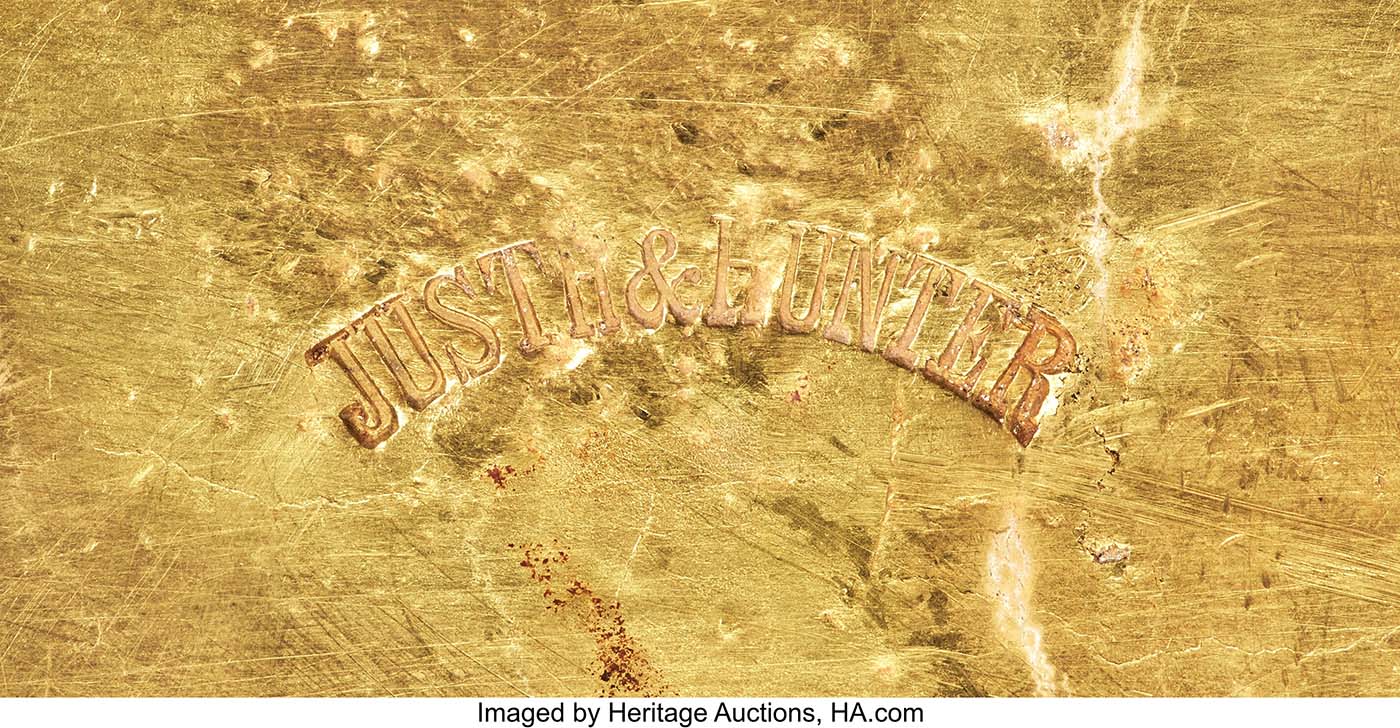

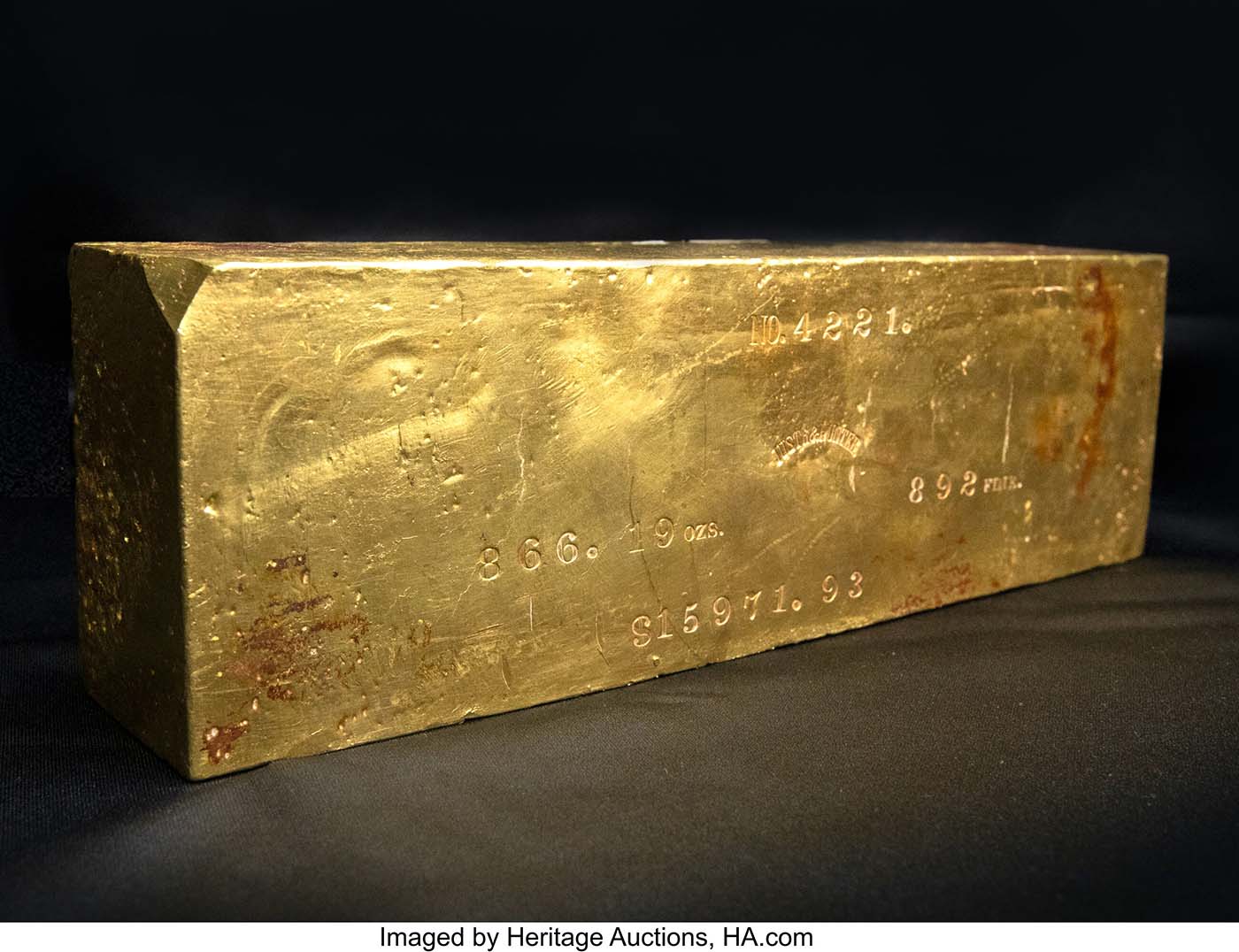

Justh & Hunter 866.19 Ounce Gold Ingot

Sold on January 14, 2022 for $2,160,000

This ingot is neatly laid out. The top side reads: NO. 4221 / curved Justh & Hunter hallmark / 866.19 OZS 892 FINE. / $15971.93. The surfaces show occasional patches of reddish patina on each side. The ingot was poured into Mold J&Hsf-15, which translates to 87 mm x 283 mm.

Justh ingots ranged from small to enormous. The smallest was 5.24 ounces, while the largest is this one from the San Francisco office weighing in at a mighty 866.19 ounces. This massive ingot is second only in weight to the “Eureka!” Kellogg & Humbert ingot, which weighs 933.94 ounces; making this Justh & Hunter ingot the largest from that assaying office known in the world, and it is also the largest ingot ever offered at public auction.

To put in perspective the contemporary value of this ingot, consider that in 1857, in New York City, the average pay for a carpenter was $1.79 per day. The 19th century work week was six days, so our average carpenter made $10.74 per week. At the stated value on this ingot of $15,971.93, this single ingot could pay the weekly wages of 1,487 carpenters.

It is little wonder that the loss of the S.S. Central America shook the financial markets in New York and was a contributing factor to the Panic of 1857.

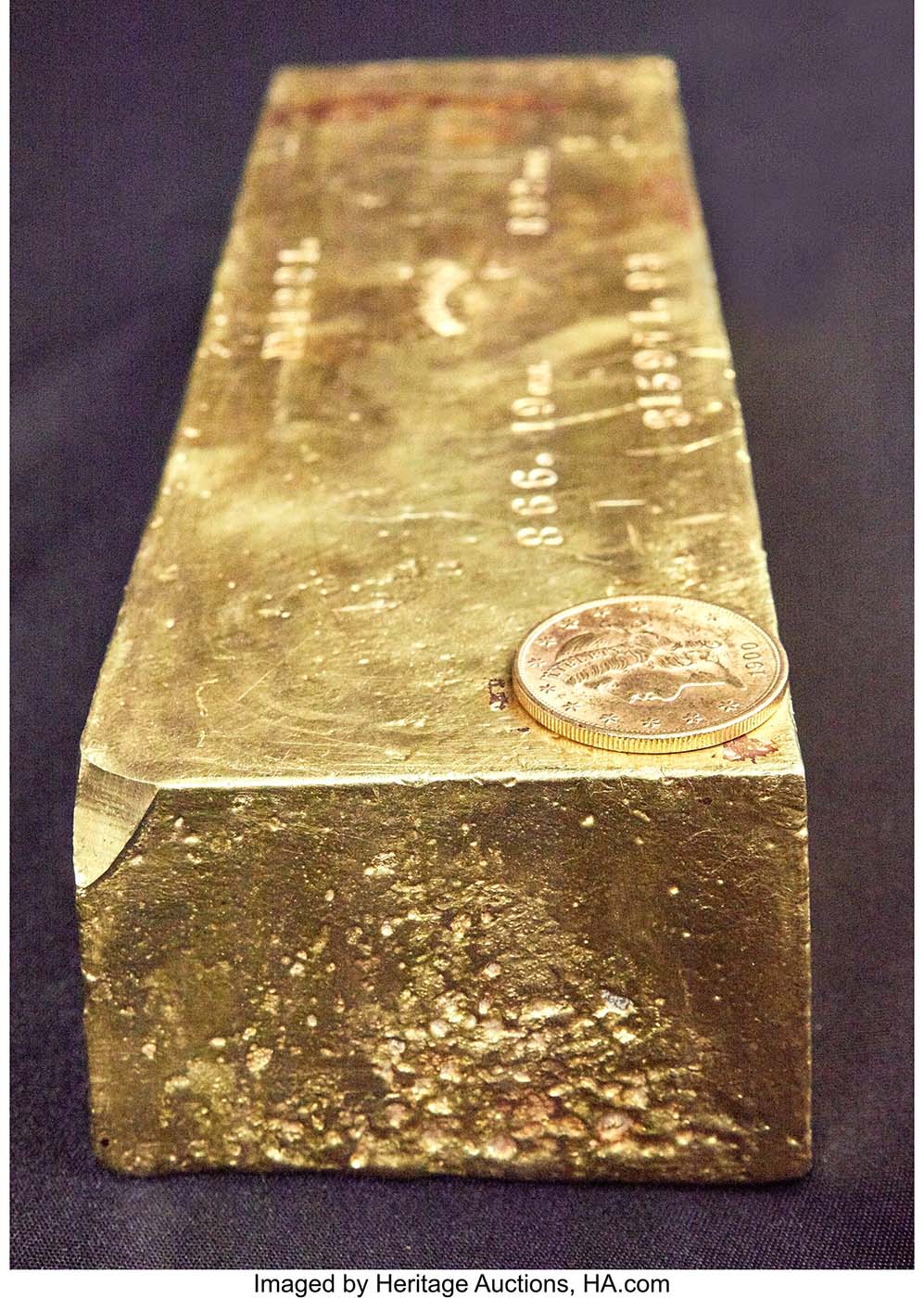

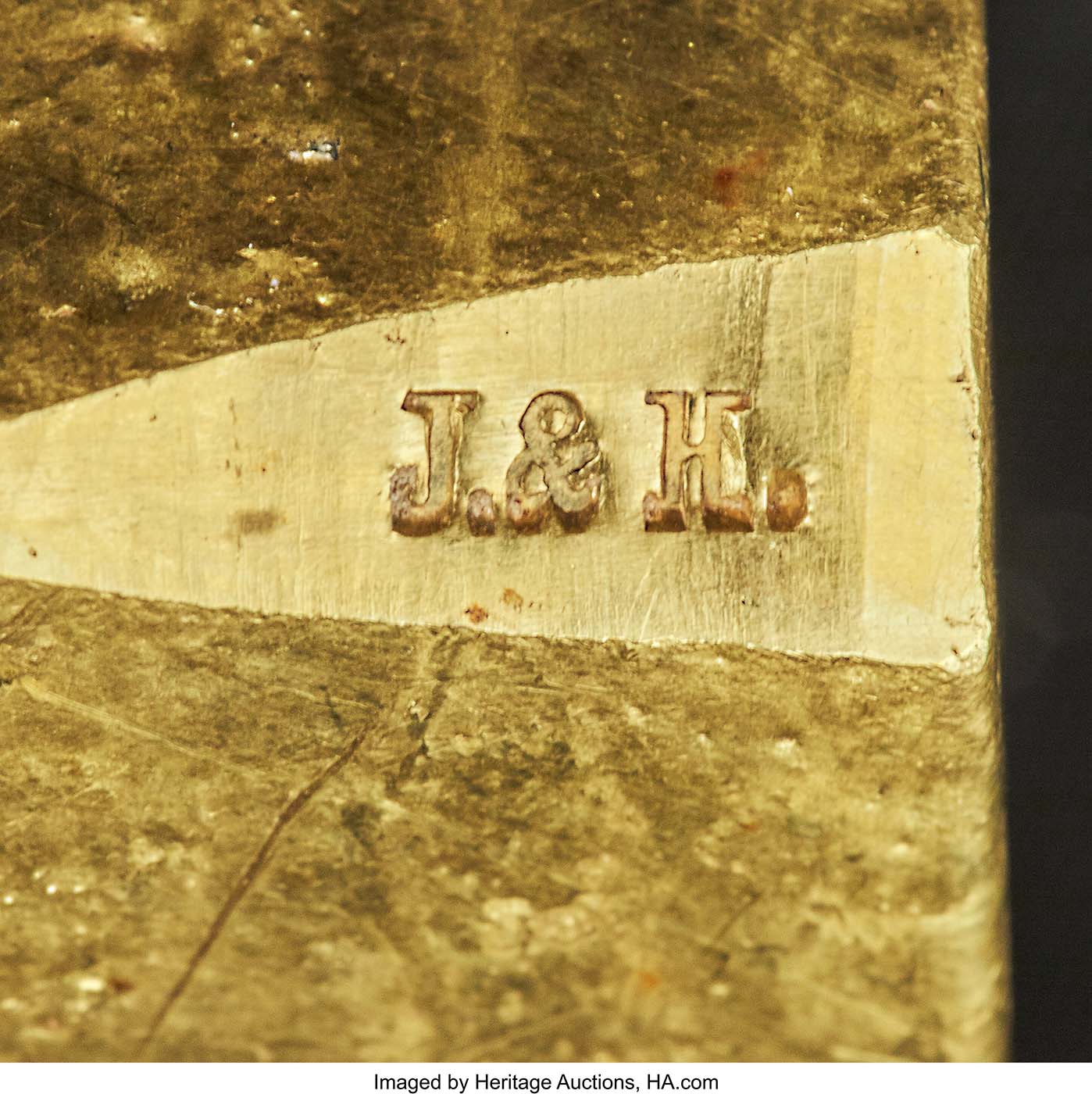

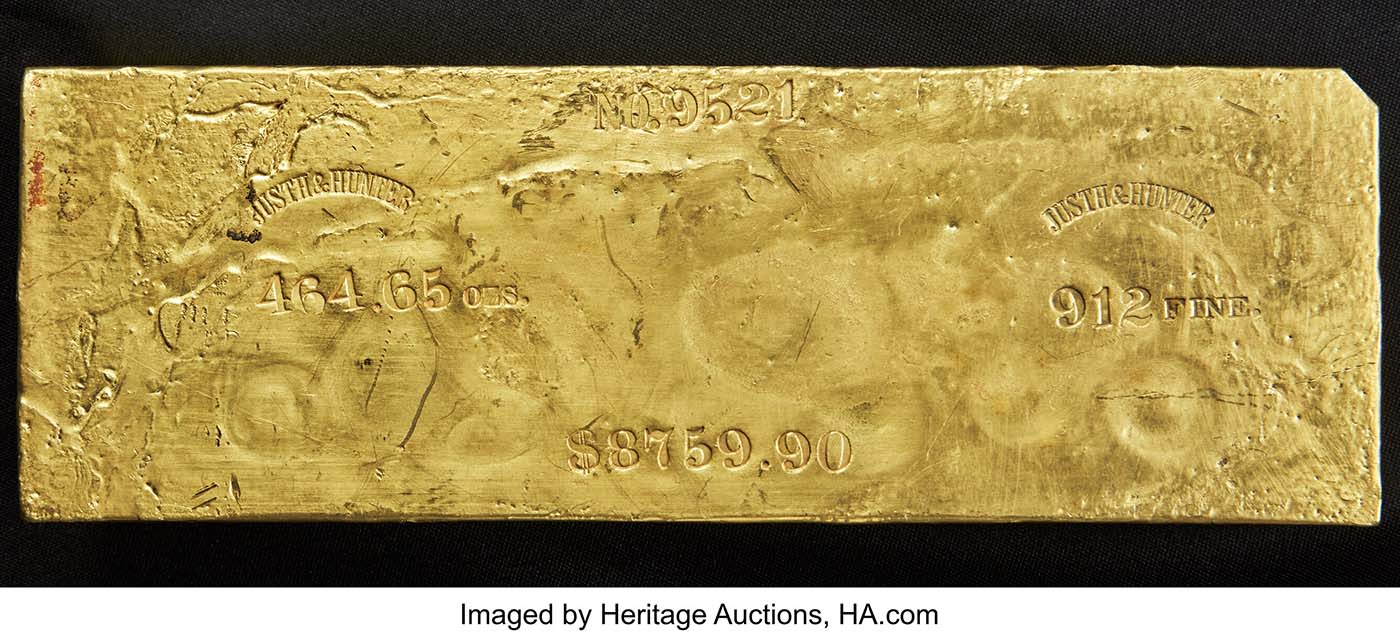

Justh & Hunter 464.65 Ounce Gold Ingot

Sold on May 5, 2022 for $1,320,000

The surfaces are bright yellow-gold, as one would expect from an ingot of .912 fineness. Characteristic of the Marysville ingots this Extremely Large Size Ingot has two company hallmarks, left and right, on the horizontally laid-out top side.

The identifying imprints are all on the top side: NO.9521 / J&H hallmark, a second J&H hallmark / 464.65 OZS. 912 FINE. / $8759.90. The ingot was poured into Mold J&Hm-08, meaning it measures 72mm x 216mm, and is 51mm thick.

One interesting feature that is common to the Marysville ingots is the presence of a tiny J&H stamp on both of the corners where the assay chips were cut. This is the largest 9000 series Marysville ingot known to exist. This ingot and its rarity and importance to the study of Gold Rush California is impossible to overstate.

Marysville, “Gateway to the Gold Fields”

One year after opening their assay office on Montgomery Street in San Francisco, Emil Justh and Solomon H. Hunter expanded to a second location in Marysville, California, 125 miles northwest. There they occupied a 20 by 70-foot one-story brick building on the south side of 1st Street near the corner of D Street. Hunter was put in charge, while Justh remained at their original location.

Marysville was home to a population of roughly 8,000 people, and had properties valued at a combined $3.3 million — evidence of a booming Gold Rush economy. Another prominent assaying firm, Harris, Marchand, & Company, also had a location in Marysville.

In 1857, $20 million in gold was shipped from that town alone to the Eastern states. Presumably, much of it was in the form of gold ingots like the one offered here.

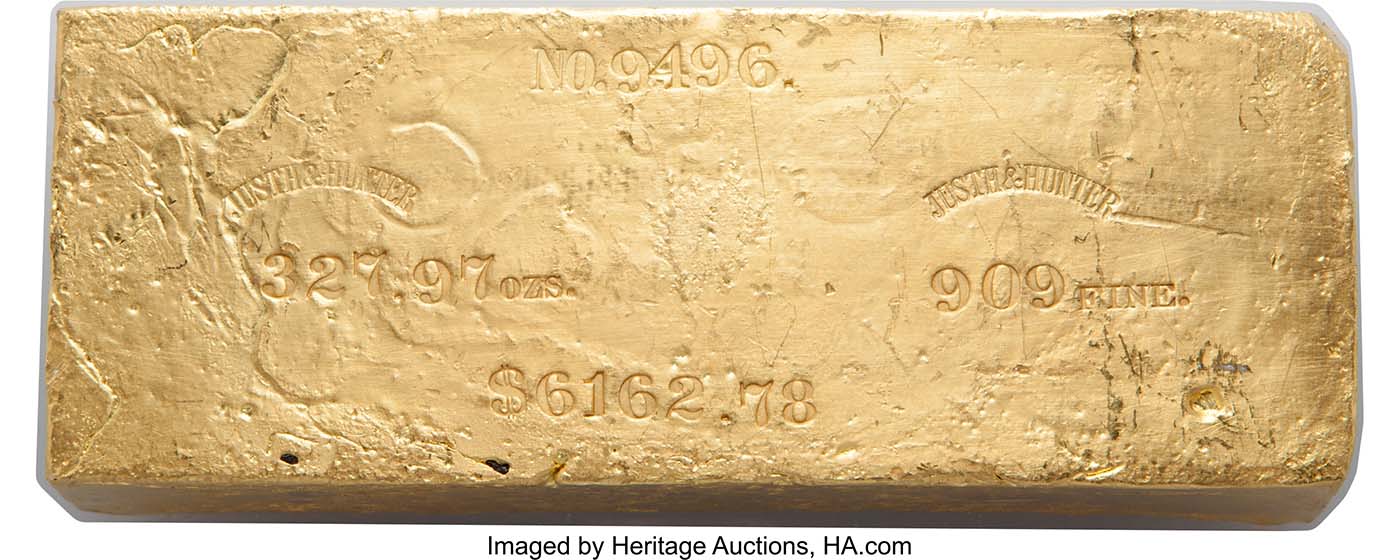

Justh & Hunter 327.97 Ounce Gold Ingot

Sold on January 5, 2017 for $564,000

This 327.97-ounce bar falls into the aptly named “extremely large size” category (300.01 ounces to 500.00 ounces). It is the second-largest Justh & Hunter bar attributed to the Marysville office after a 464.65-ounce ingot, and had a value of $6,162.78 at the time it was cast.

Curiously, neither Justh nor Hunter had much experience in assaying, certainly not what one might think would be necessary to start a business in that line of work. Prior to settling in California, Justh had a background in lithography and Hunter was a merchant in the shipping industry in Baltimore.

Justh gained what must have been invaluable knowledge while working as an assistant assayer during the San Francisco Mint’s first year in operation, but S. H. Hunter’s qualifications as an assayer are unclear. His apparent inexperience did not hamper Justh & Hunter’s success.

Reputation and Innovation

Justh & Hunter began advertising in California newspapers in May 1855. They guaranteed all assays and promised to pay the difference “arising from the same with any of the U.S. Mints.” Promotional material also included endorsements from San Francisco Mint Superintendent Dr. Louis Aiken Birdsall and Assayer Agoston Haraszthy, with whom Justh had worked from April 1854 until May 1855.

Despite minimal field experience, Justh & Hunter quickly established themselves as a reputable and skilled duo. In February 1856, less than a year into their endeavor, the two men received high praise when The Mining Magazine published an article entitled, “Invention in the Process of Gold Refining.” The author explained that the firm had adopted a revolutionary technique in refining gold:

“Messrs. Justh and Hunter, assayers, have adopted in their assay office in San Francisco, a late Parisian invention of great convenience in gold-refining. This invention is the use of gas instead of the sand-bath in boiling the assays. … Messrs. Justh and Hunter are, we believe, the first introducing this invention in the United States. It should at once be adopted in all the Mints, where it would save much labor, inconvenience, and expense.”

Another testament to Justh & Hunter’s superior refining capability appeared in the Weekly California Express (Marysville, California) on January 29, 1859. The article listed the average fineness of deposits at the San Francisco Mint for 1858, noting that the second quarter average was significantly higher than the others.

The reason was clear: “23.5 per cent of the deposits in May and June were bags of refined gold from the private refinery of Justh & Hunter.” (By that time, though, the firm ceased to exist. Justh & Hunter ended their partnership on July 10, 1858.)

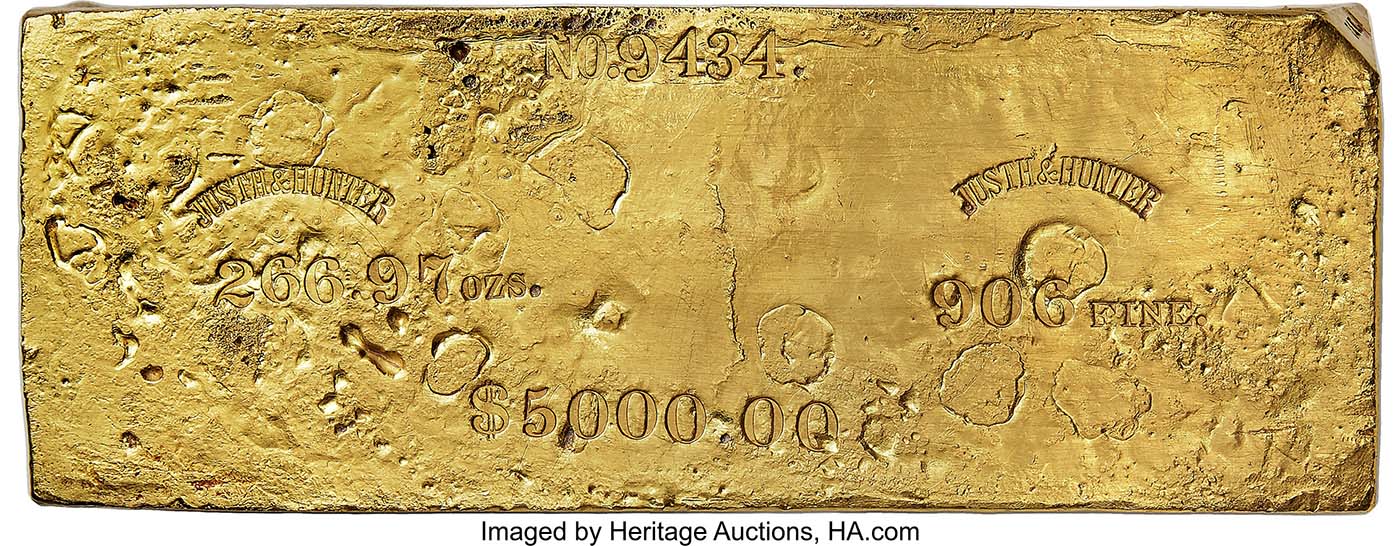

Justh & Hunter 266.97 Ounce Gold Ingot

Sold on June 6, 2019 for $420,000

This ingot measures 177 x 66 x 39 mm. All the imprints are on the top side and there are two company hallmarks: NO. 9434 / company hallmark left / 266.97 OZS. / company hallmark right / 906 FINE. / $5000.00.

The surfaces are bright yellow-gold with only the slightest trace of patina from the rusted ship’s hull. An important and very scarce Very Large Size ingot from the Marysville office of Justh & Hunter.

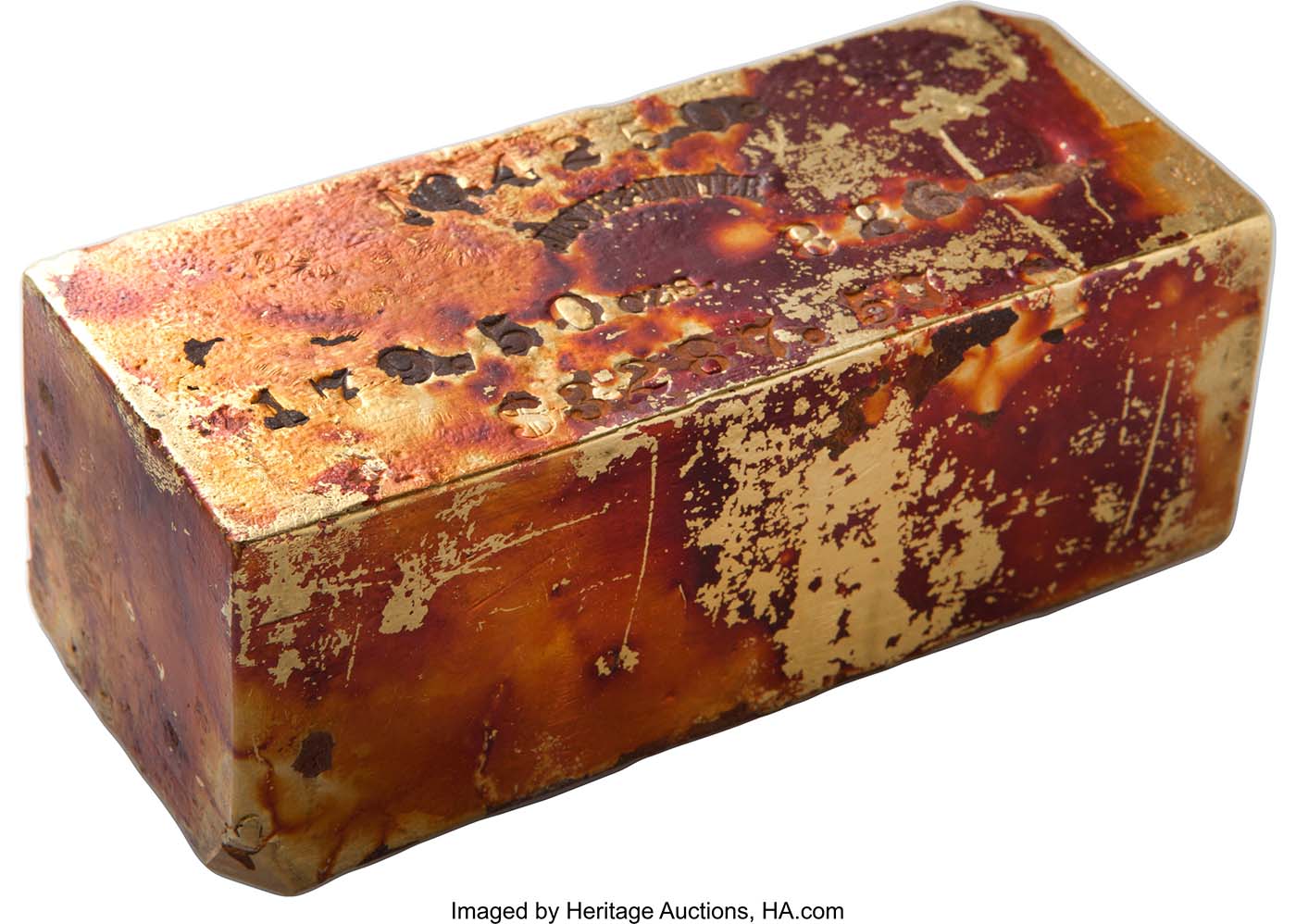

Justh & Hunter 179.50 Ounce Gold Ingot

Sold on January 5, 2017 for $376,000

This ingot is remarkable in several ways. First, of course, is its massive size. Second, this is the only ingot cast from this mold size. Third, it retains evidence on all six sides of the rusted iron hull of the S.S. Central America. For those collecting by mold size, this is from mold J&Hsf-09, and is the only one as such.

The devices are laid out horizontally on the top side and can be somewhat of a challenge to read because of the heavy incrustation of iron oxide. The top side is laid out: NO. 4250 / J&H logo / 179.50 ozs / 886 FINE / $3287.50. The last two numbers of the serial number (50) are repeated on the back side. The ingot measures 124 x 51 x 47 mm.

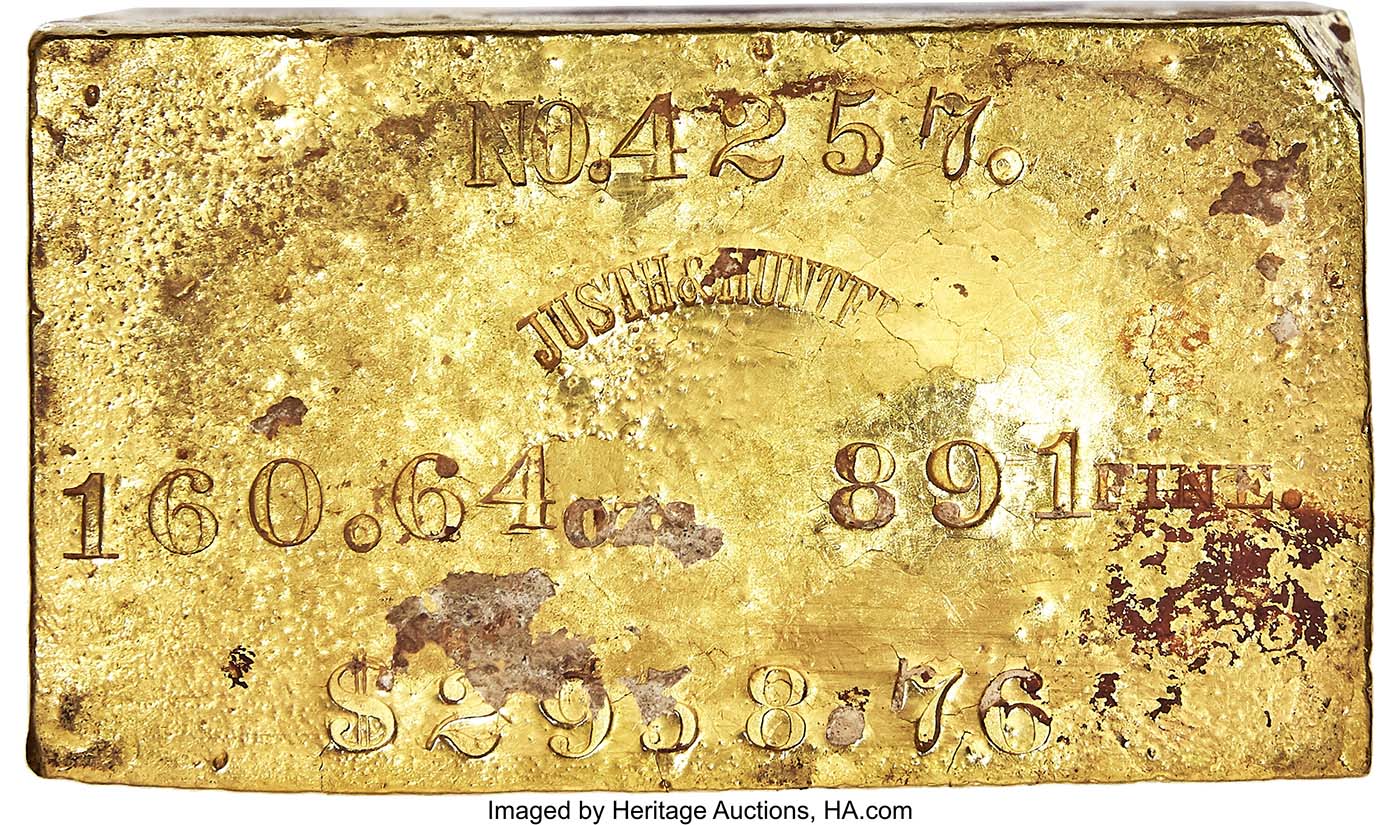

Justh & Hunter 160.64 Ounce Gold Ingot

Sold on January 13, 2021 for $372,000

This is a Very Large size ingot with an unusual, almost cube-shape. As with all gold ingots its heft in hand is considerably more than its appearance might suggest. The top side is laid out horizontally: NO. 4257. / J&H hallmark / 160.64 OZS 891 FINE / $2958.76.

The top side shows just the faintest smudge of rust, while the back side is almost covered with incrusted rust from the iron hull of the ship, with scattered patches seen on the other four sides.

This ingot was poured in San Francisco, rather than at their Marysville office, as seen by the 4,000 series used for the serial number; the Marysville office used a 9,000 series.

One of the earliest records of the partnership between Justh and Hunter is a May 23, 1855 article published by the Daily Alta California:

On May 29, 1857, a new partnership was announced between Justh, Hunter, and Charles Urzay, a former partner of Agoston Haraszthy at the Eureka Gold and Silver Refinery. The joint venture was short-lived, and Urzay left the partnership on August 15 of the same year.

Less than one year later on July 5, 1858, Justh and Hunter issued a statement confirming that “no bullion for refining and coinage will be received by us until further notice …” Their relatively brief but remarkably successful partnership formally ended on July 10, 1858 upon S.H. Hunter’s withdrawal from the firm.

Kellogg & Humbert

The story of John Glover Kellogg exemplifies the history of the California Gold Rush and the entrepreneurial spirit of those who were drawn to it in the mid-19th century. Born in Marcellus, Onondaga County, New York on December 3, 1823, J. G.

Kellogg attended a number of schools including the Homer Academy in New York State, as well as schools in Kalamazoo and Marshall, Michigan. Kellogg returned to his native state at the age of 18 to study law at Auburn before the excitement of the California Gold Rush persuaded him to travel to San Francisco, where he landed on October 12, 1849.

Kellogg quickly secured a position with the firm of Moffat & Co., overseeing the production of fifty dollar slugs that had been granted by government contract. He remained with the firm for four years, through relocations and transitions in ownership under the direction of Curtis, Perry, and Ward.

The company shut its doors on December 14, 1853 in preparation for the opening of the San Francisco Mint in April 1854. Only five days later, on December 19, 1853, Kellogg formed a partnership with G. F. Richter, a former cashier and assayer at Curtis, Perry, and Ward. “Kellogg & Richter” at once began assaying operations and immediately earned the confidence of the public.

Kellogg & Humbert 121.61 Ounce Gold Ingot

Sold on January 14, 2022 for $336,000

This ingot is in the Very Large class and is a hefty handful of gold. The top side is neatly laid out: No 951 / K&H hallmark / 121.61 Oz / 897 FINE / $2254.96. The surfaces are bright yellow-gold throughout with no traces of rust from the iron hull of the ship. This ingot was poured into Mold K&H-04, which measures 55 mm x 111 mm.

The Coinage Problem

It would be logical to assume that the enormous quantities of gold ore extracted from northern California during the late 1840s through the 1850s resulted in the ready availability of coins. But that simply was not the case, as Larry Schweikart and Lynne Pierson Doti argue in their 1998 article, “From Hard Money to Branch Banking: California Banking in the Gold-Rush Economy.” The authors explain, “the California experience demonstrated the critical role that financial intermediaries play in evolving market systems, even when a suitable ‘money’ was widely available.”

The problem that plagued California following the discovery of gold was a shortage of coin. According to the authors, “despite the abundance of gold, the United States did not open a mint in San Francisco until 1854, meaning that the scarcity of coin persisted amidst an ocean of gold. Additionally, “All customs had to be paid in U.S. coin, which led to hoarding of the few pieces of metallic currency that existed.”

Day-to-day transactions were often conducted using unrefined gold dust, which varied widely in purity, often contained other elements mixed in, and had to be traded by weight. Weighing gold dust meant most settlers needed to carry a set of scales around in addition to carrying pouches of gold dust. Arguments and negotiations over the value of gold dust, which depended weight, including properly calibrated scales, and purity, were commonplace.

This is where private assayers played a crucial role in the California Gold Rush economy. John Grover Kellogg and Augustus Humbert were among a group of men who set up assaying and coining businesses in the late 1840s and early 1850s to provide the invaluable service of supplying depositors of gold dust with refined bars, ingots, and coins for use in local commerce.

The wheat quickly separated from the chaff, with certain firms establishing their reputations as honest and respected refiners, and others proving themselves either incapable or disinterested in manufacturing ingots and coins of proper weight and fineness.

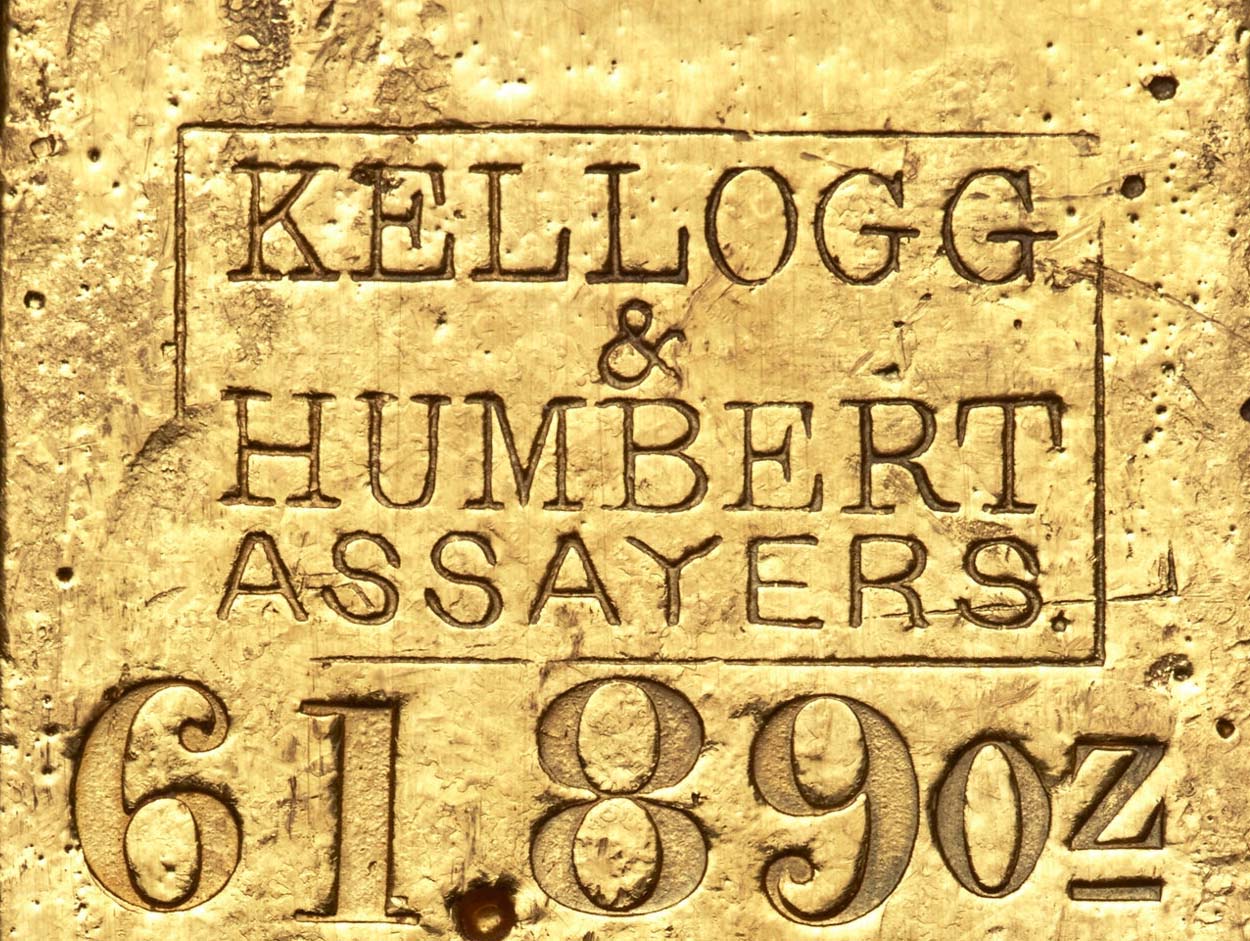

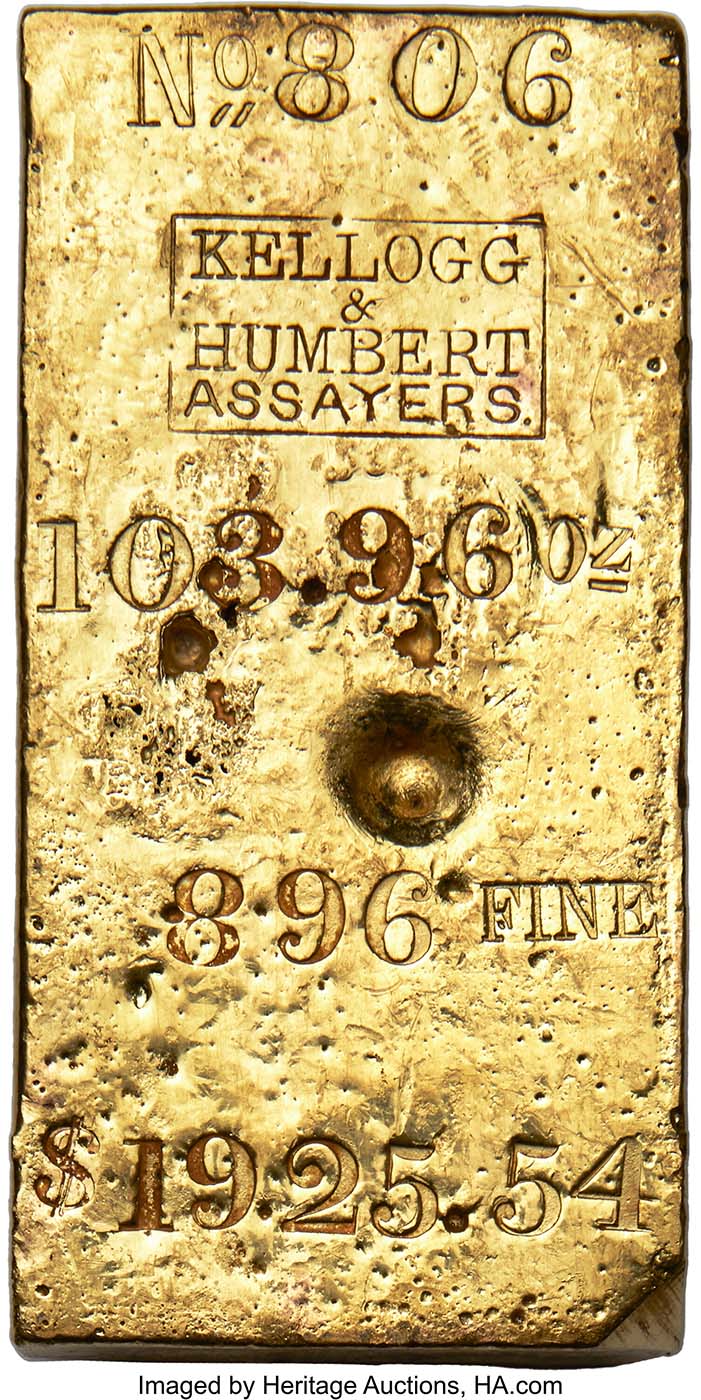

Kellogg & Humbert 160.05 Ounce Gold Ingot

Sold on August 14, 2019 for $312,000

This ten-pound ingot is in the Very Large Size class. The surfaces are bright yellow-gold with no traces of reddish patina on any of the six sides. Because of its size, the legends are vertically oriented and laid out on the top side: No 728 / K&H hallmark / 160.05 Oz / 884 FINE / $2924.73. The serial number is repeated on the back, in a different font. The ingot measures: 63 x 146 x 40 mm.

Several weeks after the opening of Kellogg & Richter a shortage of circulating gold coins compelled a group of bankers and bullion dealers from San Francisco and Sacramento to request the firm produce gold coins for circulation. Output rapidly swelled to over $6 million in twenty dollar gold pieces.

Kellogg remained in the coining and assaying business in San Francisco until 1866. He subsequently returned to New York for a retirement of leisure and travel, having solidified his place in the history of the California Gold Rush.

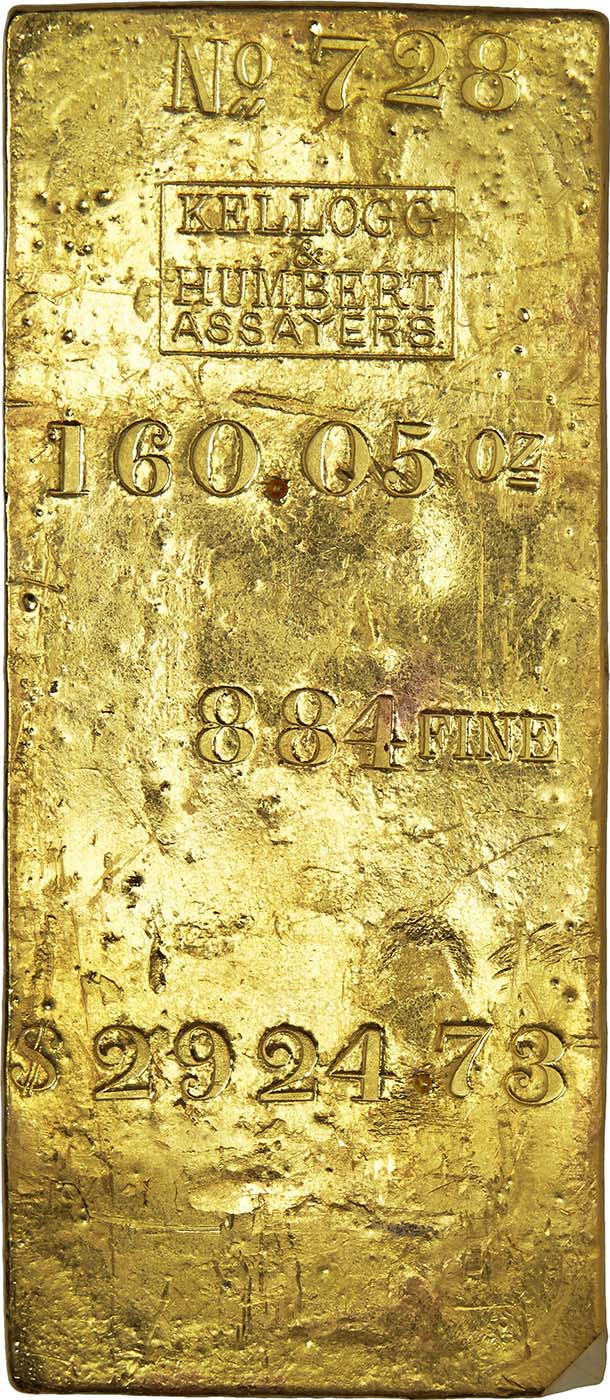

Kellogg & Humbert 103.96 Ounce Gold Ingot

Sold on August 24, 2022 for $240,000

This particular bar is classed as a Very Large Size Ingot. It was poured into Mold K&H-04, which means it measures 55mm x 111mm. The top side is nicely laid out, vertically: No 806 / (K&H hallmark) / 103.96 OZ / 896 FINE / $1925.54. The surfaces are bright overall, and the top side especially so.

Augustus Humbert was held in equally high esteem in Gold Rush California. Well known as the former United States Assayer of Gold in San Francisco, in the October 23, 1855 issue of the Alta California, Humbert was designated as ” … a man who has done more than any single person we know of for the state … ” John Kellogg and Augustus Humbert founded their assaying and coining firm in 1855 and the partnership remained in business until 1860.

As a testament of the public trust in Kellogg & Humbert, when the first recovery of the S.S. Central America was conducted in the late-1980s there were 341 ingots recovered from this firm (far more than any of the other firms), ranging in size from 5.71 ounces to 933.94 ounces.

Blake & Co.

Gorham Blake got his start in the mining and assaying business at the age of 21 when he was appointed as the Superintendent of Iron Mines in Vermont. But that was a short-lived career move. The following year, Gorham and his brother Frank W. Blake took a ship west, and arrived in San Francisco on May 22. Gorham was soon employed by Wells Fargo to purchase gold dust.

In 1853 he became the principal owner and superintendent of the Shaws Flat Ditch as well as the principal owner of the Dardanelles Mine in El Dorado County. That same year he also founded Blake & Co. as an assaying company.

Blake established his reputation among miners by guaranteeing to pay any difference between the correctness of his assay and that determined by the U.S. Mints. That set a high bar for trustworthiness among the local miners. He further promised to return all assays within six hours, payable in bars or coins.

No other assaying company went to the effort to have their ingots present so well. Other companies were also reliable assayers, but that was their exclusive intent. Only Blake ingots were made with the possible intent to circulate.

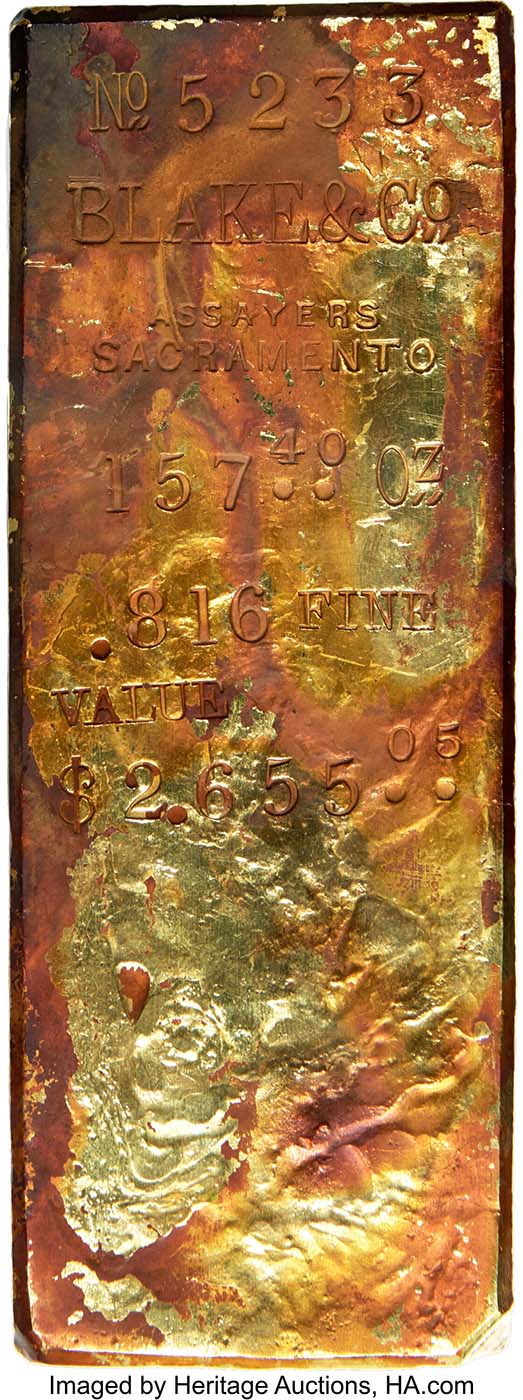

Blake & Co. 157.40 Ounce Gold Ingot

Sold on August 15, 2023 for $564,000

This is the largest Blake & Co. ingot known. It falls in the “very large” category. It is a long bar, and the only one from this mold, suggesting the mold may have been made specifically for this particular ingot. The inscriptions are vertically laid out: No 5233 / BLAKE & Co / ASSAYERS / SACRAMENTO /157.40 Oz / .816 FINE / VALUE / $2,655.05. Poured into Mold B-05, which translates into 55 mm x 149 mm.

Private Assayers

It may fairly be asked why private minters and assay offices were allowed to operate in Gold Rush California. The short answer is, it worked. John Jay Knox wrote a lengthy summation in 1866 addressing this question and others, which was published in The Annual Report of the Director of the Mint. Knox’s extended explanation included these observations:

“Private assayers will conduct their business much more economically than government officers, and the large quartz mills will in most cases do their own assaying, even if government offices are located in the same towns. Assayers of well established reputations will obtain from large mining corporations compensation for their services, in most cases, nearly or quite double the salaries paid by the United States, or they will earn much more in a private capacity than they will receive if in the employ of the government.”

“The result will be, therefore, that the United States will obtain and retain only indifferent assayers and workmen, or those in its employ will endeavor to increase their pay illegitimately, thus subjecting the United States assay officers to the same charges of injustice and fraud with which private individuals are sometimes accused … “

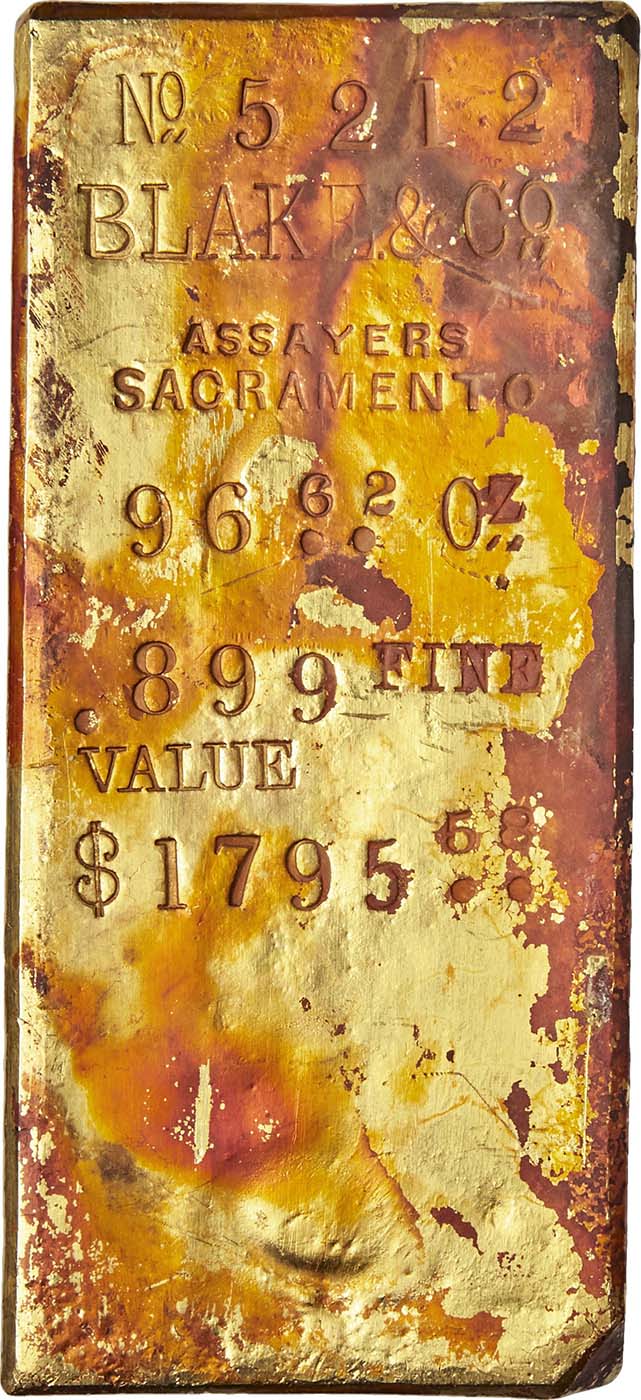

Blake & Co. MS 96.62 Ounce Gold Ingot

Sold on August 14, 2019 for $384,000

No. 5212 / BLAKE & Co / ASSAYERS / SACRAMENTO / 96.62 Oz / 899 FINE / VALUE / $1795.58. Poured into mold B-04, resulting in dimensions of 55 x 124 mm and 25 mm thick. Each of the six sides shows deep coppery-colored incrustation from the rusted iron hull of the ship. A rare and important Large Size ingot from Blake & Co.

Blake & Co. MS 19.15 Ounce Gold Ingot

Sold on April 25, 2019 for $168,000

This small, almost square ingot is 42 x 52 x 13 mm, confirming it was poured from Mold B-02. Only five fixed-sized molds were used for Blake ingots, in addition to the adjustable length “Twix Mold.” Mold B-02 is the smallest of the fixed-size molds. The top face reads: BLAKE & Co / ASSAYERS / SACRAMENTO / 892 FINE / VALUE / $353.11.

The surfaces show the usual care given to Blake ingots. The surfaces are all polished or finished to a nearly mirror-like brightness. The edges are also beveled. These two touches in the production of these bars suggest they may have ultimately been intended as a circulating medium of exchange.

Blake and Agrell’s assay office in Sacramento was established in 1855 but the partnership lasted less than two months. The successor company, also in Sacramento, was closer to the gold fields than was San Francisco (where most assayers were located), and assayers in that city enjoyed a brisk trade. Blake & Co. apparently only had one local competitor, Harris, Marchand & Co.

Both firms were located on J Street. During 1856, Blake & Co. assayed 200,000 ounces of gold. The fineness of the ore they assayed varied considerably, according to the mine’s location. The highest fineness was from Michigan Bluff at $20.15 per ounce, the lowest was gold from Carson Valley that came in at only $12.13 per ounce.

The gold in this particular ingot is among the higher-grade ores mined in the region, valued at $18.43 per ounce. Confirmation of the high-grade ore can also be seen by the fineness stamped on the bar, 892 Fine.

Henry Hentsch

Ingots assayed by Henry Hentsch are among the scarcest bars found in the recovery of the S.S. Central America. They are second only (just barely) to those of Blake & Co. A total of 38 Hentsch ingots were found in both recovery efforts (in the late-1980s and 2014). In the 2014 season, five additional Hentsch ingots were located in addition to the 33 known from the initial recovery efforts from the late-1980s.

Of the five assaying firms represented by the two major recovery efforts of the S.S. Central America, two had international reputations, Harris, Marchand and Henry Hentsch.

Desiré Marchand had earned the right to use his own registered assayer’s stamp when he was a teenager, and Henry Hentsch was the scion of a prominent banking Swiss banking banking. Hentsch could have easily remained in Switzerland and led a comfortable life in the family business (a business that included assaying). Q. David Bowers states Hentsch’s position as: “In January 1854 he sought adventure and new opportunities, although he was hardly lacking wealth.”

Hentsch did indeed seek adventure and arrived in San Francisco on May 31, 1854. Shortly after arrival he established a small banking office. This in itself was not surprising in Gold Rush California, but unlike many of his California competitors Hentsch already extensive experience in the banking business dating back to 1842, working with Hentsch & Cie. in Switzerland.

Combining Henry Hentsch’s experience in banking, international connections, and ability as an assayer, A California Gold Rush History brings these abilities to a natural conclusion:

“Drawing upon his international connections Hentsch listed references which included Melly, Romilly & Co., Liverpool; Morris, Provost & Co., London; Coulon & Co., London; Mathieu Hentsch & Co., Paris; and Hentsch & Co., Geneva, Switzerland. As European banks and gold dealers were a major destination for California gold bars, these endorsements no doubt attracted bullion depositors with such customers in mind.”

With such name recognition in Europe, Henry Hentsch was able to carve out a niche market in the assaying and transport of gold to world markets, a market where Desiré Marchand was his only serious competitor. His international reputation increased even more when he was appointed the official consul for Switzerland in 1859.

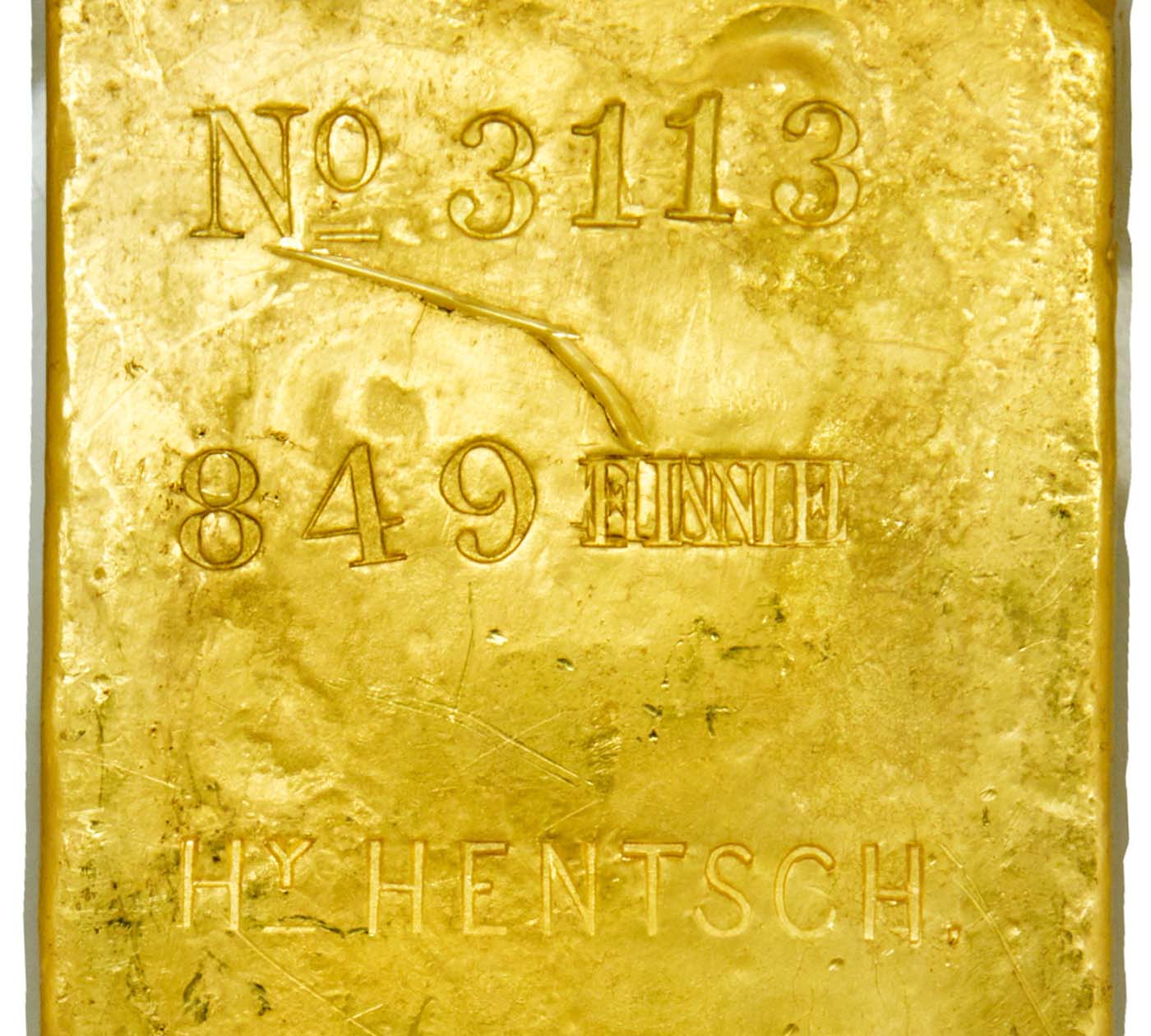

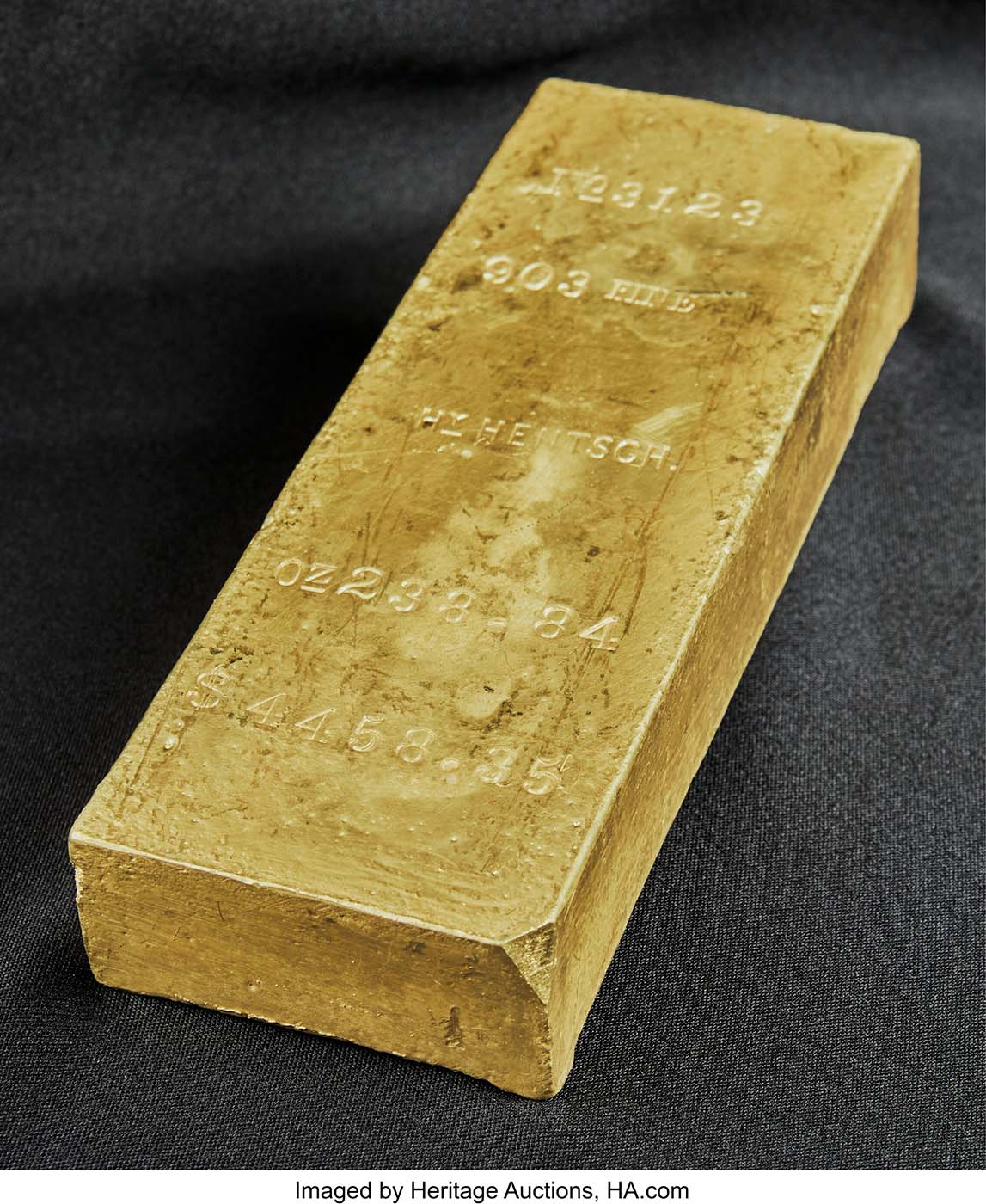

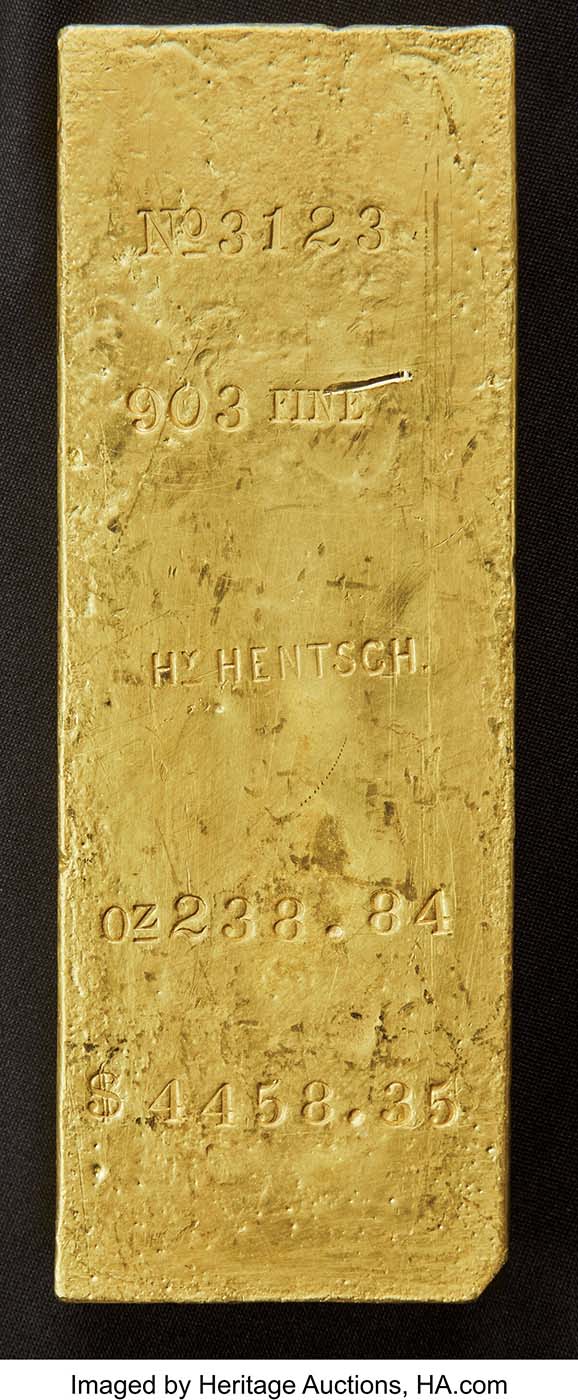

Henry Hentsch 238.84 Ounce Gold Ingot

Sold on May 5, 2022 for $540,000

The top side is laid out vertically: No 3123 / 903 FINE / Hy HENTSCH / Oz 238.84 / $4458.35. The serial number is repeated at the top of the back side. Cast from mold HH-06, measuring 68 mm x 109 mm. This is a nicely poured ingot that displays even yellow-gold color throughout.

Henry Hentsch, a Swiss national, arrived in San Francisco on May 31, 1854 via the S.S. Sonora. According to Dave Bowers, he was “born into a prominent banking family on July 23, 1818” and “became prominent in San Francisco banking, real estate, and other endeavors, including assaying.”

By 1854, Hentsch was 36 years old with considerable experience in the family business back in Switzerland, having worked for Hentsch & Cie since 1842. It was a natural move, then, for Hentsch to announce in the February 2 issue of the Alta California:

ASSAY OFFICE OF HENRY HENTSCH

Northwest corner of Montgomery and Jackson streets. I have this day annexed to my Banking Establishment an Assay Office, and am prepared to carry on this business in all its branches. All orders confided to my care will be executed with promptness, and I will guarantee all my assays.

H. Hentsch.

San Francisco, February 1, 1856.

Henry Hentsch 154.23 Ounce Gold Ingot

Sold on November 8, 2018 for $336,000

This is classed as a Very Large Size Hentsch ingot; in fact, the fifth largest Hentsch ingot recovered from the S.S. Central America. The top side is laid out in the usual fashion in vertical format: No 3125 / 893 FINE / Hy HENTSCH / Oz 154.23 / $2847.07.

The ingot number is repeated at the top of the back side in the same font and size as seen on the top side. Noticeable incrustation from the ship’s rusted hull is seen on the long left side with a lesser presence seen on the top and back sides. The ingot measures 58 x 158 x 31 mm.

Unlike most immigrants to the United States in the 19th century, Henry Hentsch remained Swiss at heart all his life and returned to Geneva, where he took over the family’s office in that city. However, his Swiss-American bank remained headquartered in San Francisco and was managed by his partner, Francis Berton, with a capitalization of $2 million (as reported in 1873).

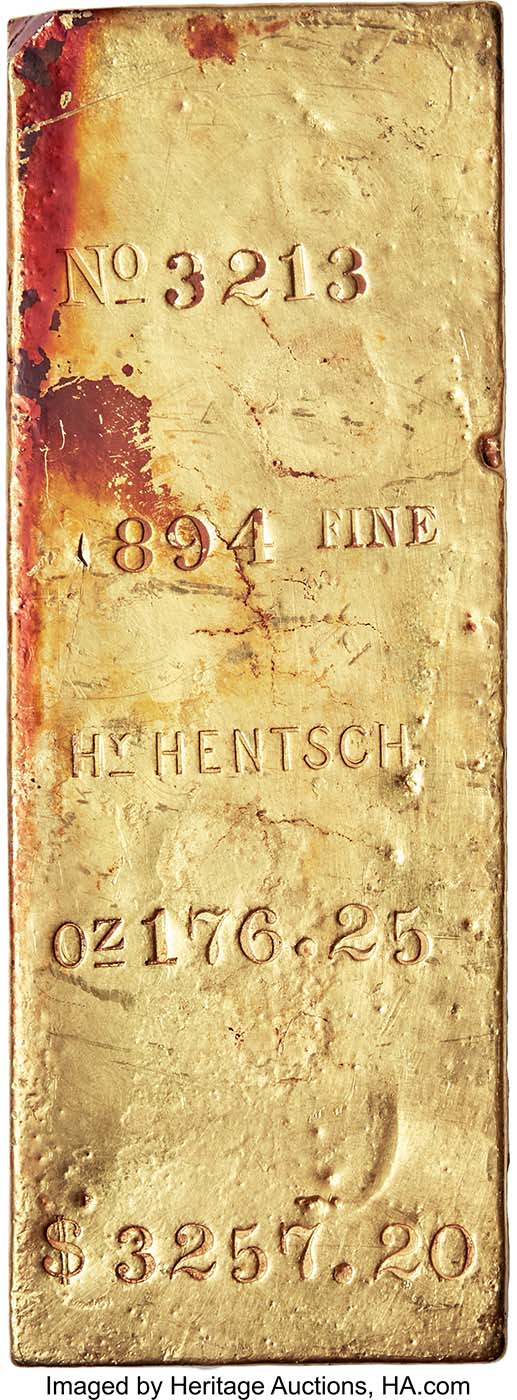

Henry Hentsch 176.25 Ounce Gold Ingot

Sold on September 5, 2019 for $324,000

This is a Very Large Size ingot that measures 57 x 157 x 33 mm. The imprints are all located on the top side and are well-spaced: No 3213 / 894 FINE / Hy HENTSCH / Oz 176.25 / $3257.20.

The success of any private assayer in San Francisco depended upon the reputation of the owners. Hentsch was not only an assayer but he was also a banker, and his assaying office was located next door to his bank on the corner of Montgomery and Jackson streets.

Hentsch was a Swiss citizen and prior to his arrival in San Francisco he apparently made a solid reputation in Europe, a reputation that transferred to his banking / assaying interests in California, where he advertised the issuance of Bills of Exchange in New York, Liverpool, London, Frankfort, Hamburg, Berlin, Paris, and Geneva.

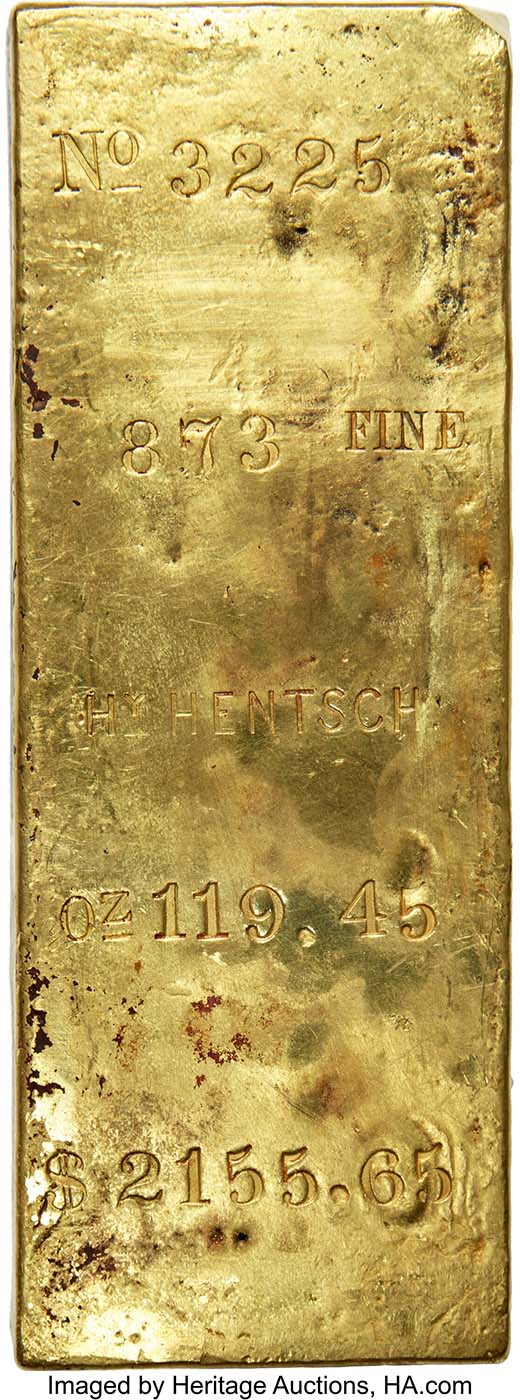

Henry Hentsch 119.45 Ounce Gold Ingot

Sold on August 15, 2023 for $300,082.80

This ingot is classed as “Very Large” sized (100.01 to 300.00 ounces), and is obviously one of the largest Hentsch ingots recovered. This is one of only five Hentsch ingots recovered in 2014. It is vertically laid out with the imprints evenly spaced: No 3225 / 873 FINE / Hy HENTSCH / Oz 119.45 / $2155.65. The surfaces retain most of their original yellow-gold color with occasional flecks and streaks of ruddy patina scattered about.

Henry Hentsch relocated his business to 120 Montgomery Street in 1858 and invested in many other businesses, owning a theater and acting as the Swiss Consul for several years. He returned to Switzerland in 1868 to manage the family bank there, leaving Berton in charge of affairs in California until his bank became part of the Swiss-American Bank in 1873. Hentsch passed away in Geneva, Switzerland in 1905, aged 87.

Harris, Marchand MS & Co.

There were 32 gold ingots or assay bars from the firm of Harris, Marchand & Co. found among the treasures of the S.S. Central America. The firm operated assay offices in both Sacramento and Marysville, California. The bars ranged from a very small 9.87-oz bar of 777 fine gold, value (in 1857) $158.53 to a very large 295.20-oz bar of 877 fineness, value (in 1857) $5,351.73.

The firm of Harris, Marchand was the only firm in Gold Rush California to use a coin-like hallmark on their ingots.

Harvey Harris, a Danish national then in his early 40s, had previously worked for Justh & Hunter and Kellogg & Co., both of which were associated (the latter as Kellogg & Humbert) with assayers of gold ingots also found in the S.S. Central America treasure.

Desiré Charles Marchand, a French-speaking Belgian (and later naturalized American) whose credentials from the Mint of Paris are mentioned in the advertisement, was extremely young at the formation of the firm; varying accounts are given of his date of birth, but in no case could he have been so old as 20 at the time of the advertisement, and might have been as young as 16. This exceedingly young age could explain why Marchand cited his credentials as opposed to his (possibly nonexistent) work experience.

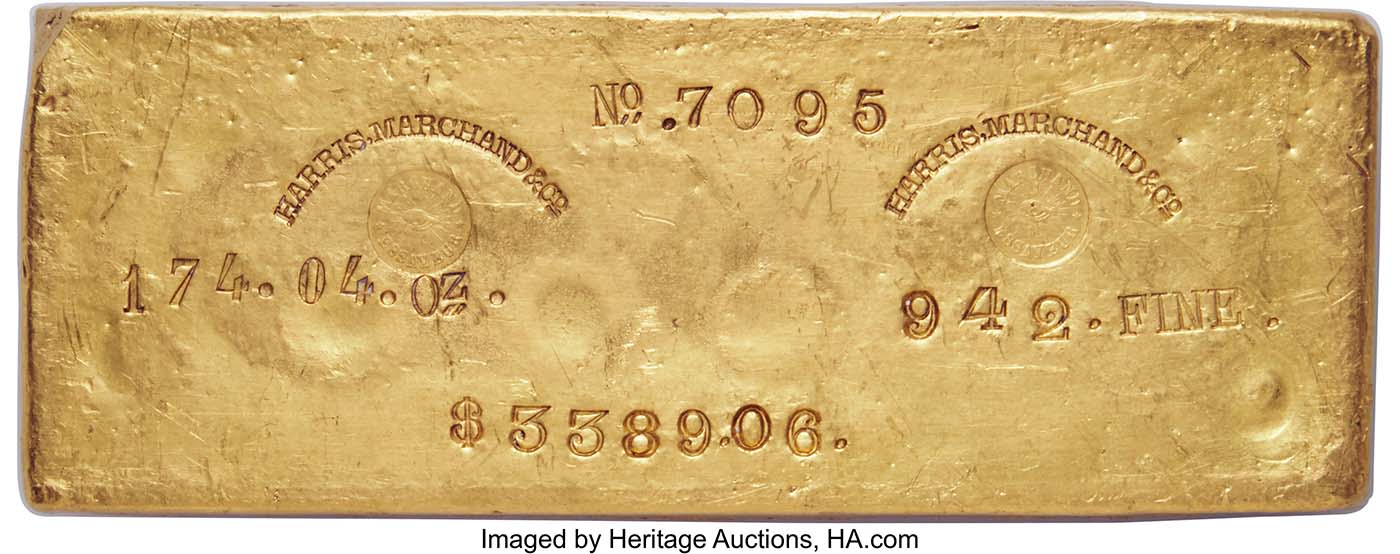

Harris, Marchand MS & Co. 174.04 Ounce Gold Ingot

Sold on January 31, 2019 for $528,000

At the top and centered is the ingot number: No. 7095. Below and centered on the left side is the Harris, Marchand oval name punch with the coin-like hallmark below with 174.04. Oz. below the hallmark. On the right side and centered is the same curved company name with the hallmark below and below is the fineness: 942. FINE.

Centered at the bottom of the top side is the ingot’s 1857 value: $3389.06. The back side was given a finished appearance by tapping. This ingot has a slightly trapezoidal shape, undoubtedly done to facilitate removal from the mold. The ingot measures: 65 x 177 x 25 mm.

Charles L. Farrington, the “& Co.” of the firm, was an American from the state of Maine, but little else is written about him in California Coiners & Assayers, except to note that he “retired from the firm” per a Sacramento Union item dated May 30, 1857. The reason is not listed, though age is a distinct possibility. The firm continued without him as Harris & Marchand Assayers.

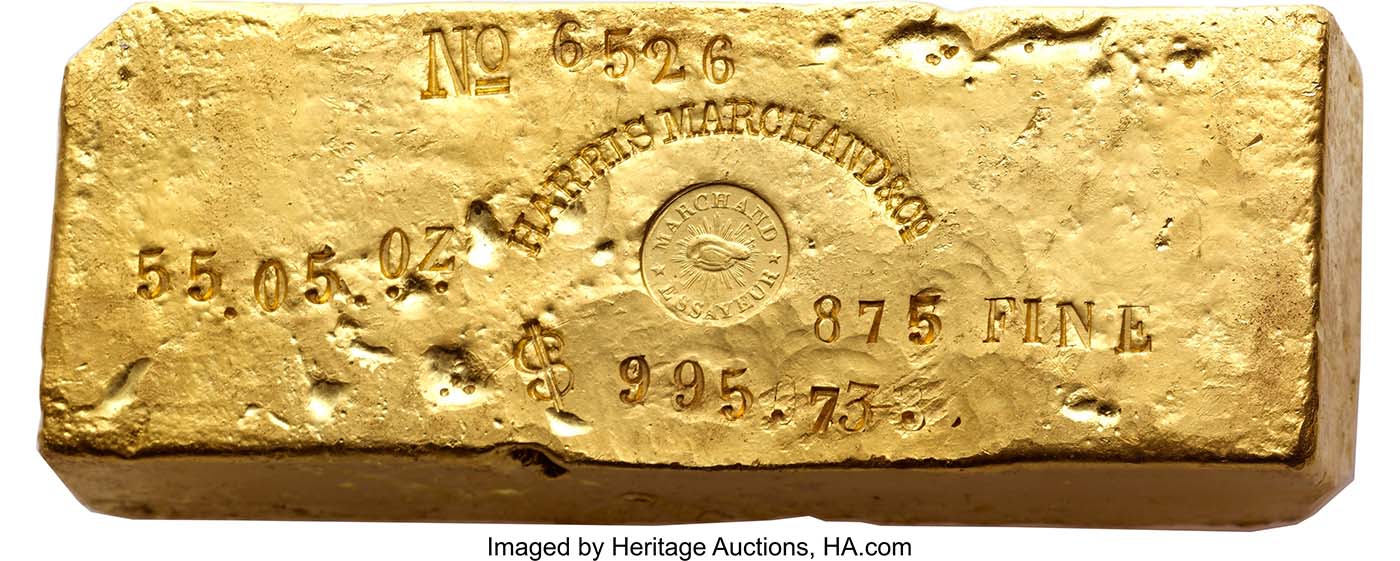

Harris, Marchand MS & Co. 55.05 Ounce Gold Ingot

Sold on February 5, 2010 for $172,500

Like the majority of known Harris, Marchand & Co. ingots, this example shows irregular punching on the serial number, weight, fineness, and value. The arcing HARRIS MARCHAND & CO imprint and circular MARCHAND / ESSAYEUR stamp, however, are precise and elegant as ever.

The ingot’s surfaces are bright yellow-gold with the usual casting irregularities on most faces, though the bottom is smoother than usually seen (as referenced by Bowers). Corner cuts are at the upper left of the top face and its absolute diagonal opposite. The ingot measures 42 x 112 x 20 mm.

Among the hundreds of gold ingots lost in the wreck of the S.S. Central America, those of Harris, Marchand & Co. were little known before the ship’s salvage in the late-1980s. Altogether there were 37 Harris, Marchand ingots recovered from the S.S. Central America, but this is the only ingot from the Marysville branch office. All the others were from their main Sacramento office.

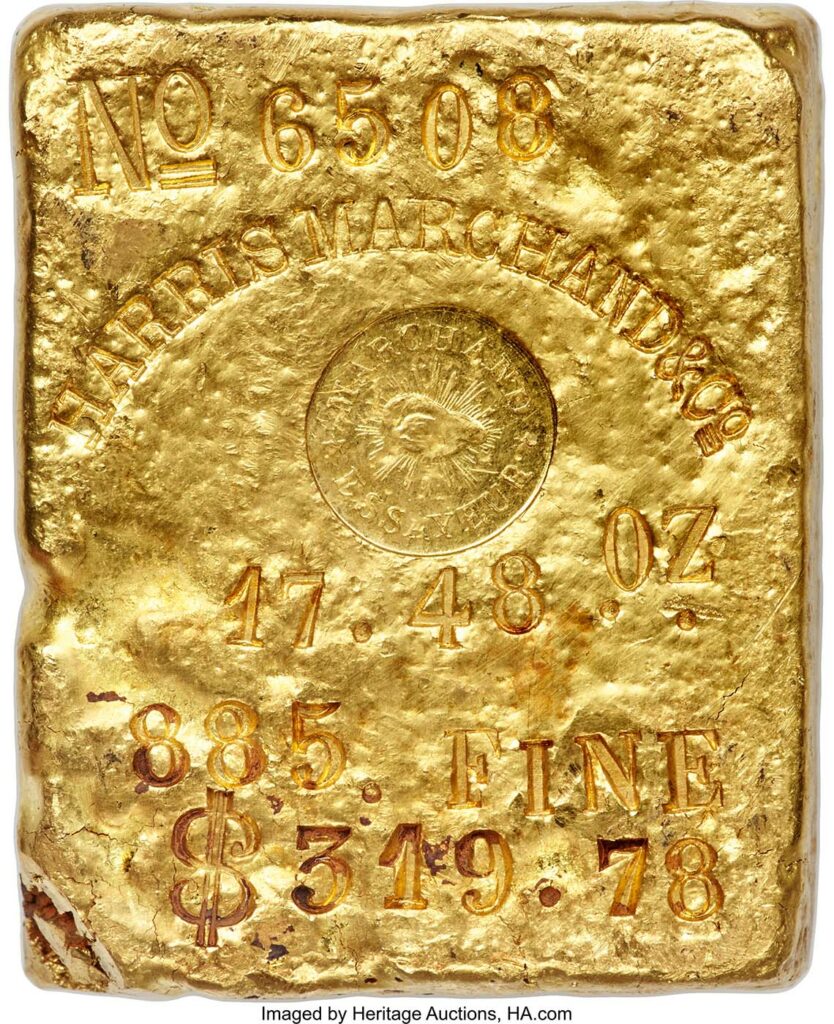

Harris, Marchand MS & Co. 17.48 Ounce Gold Ingot

Sold on March 14, 2019 for $144,000

This small to medium-sized ingot is nearly square with all the inscriptions on the top face. That side is laid out: No 6508 / curved H&M logo / circular H&M coin-like hallmark / 17.48 OZ. / 885. FINE / $319.78. Most of the surfaces are yellow-gold, except for a patch of iron ore rust from the ship’s hull that still adheres to the lower portion of the back side and tiny portions of rust seen on the lower-left corner. The ingot measures: 40 x 50 x 12 mm.

Though the firm Harris, Marchand & Co. did not last into June 1857, the gold bars stamped that way did, and three dozen bars from the Sacramento office received an unexpected gift of numismatic immortality: they were loaded onto the S.S. Central America, and instead of going to New York to be melted down, they landed at the bottom of the ocean, and over the course of more than a century, they transformed into historic treasures.

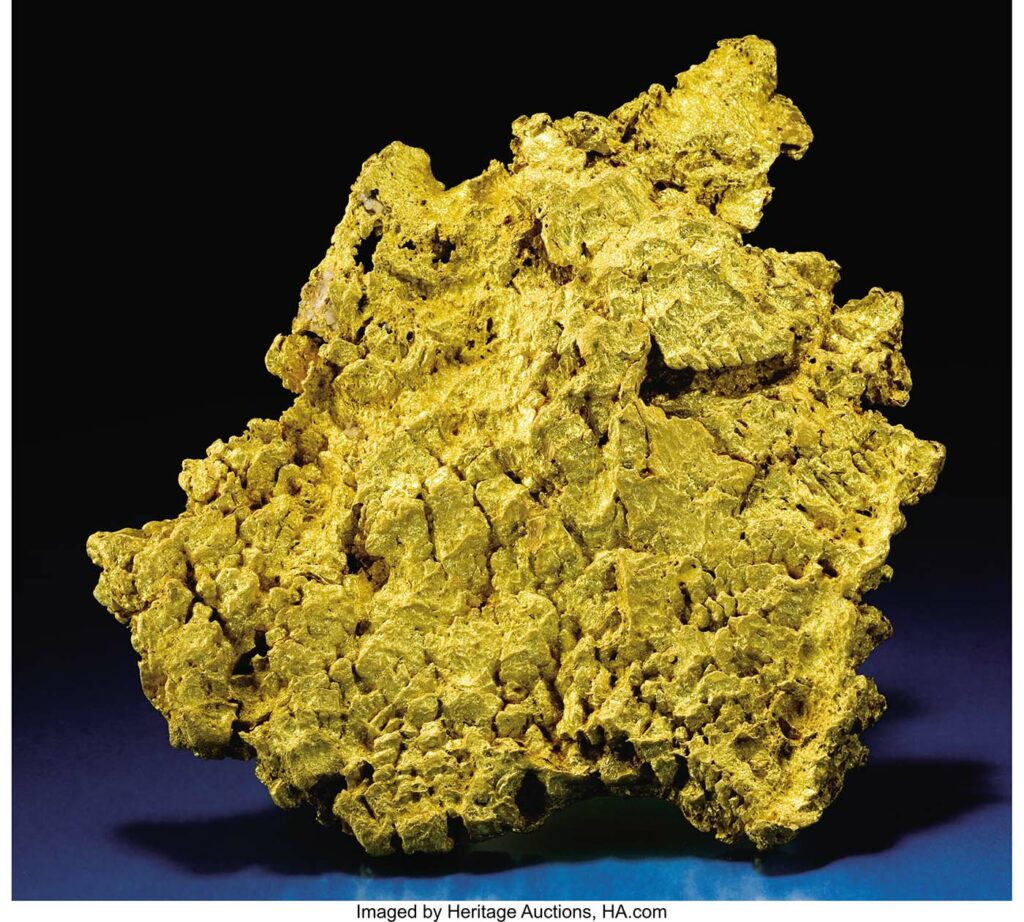

Gold Nuggets at Auction: Stunning Specimens 10k and Above

Historically, very few large nuggets were saved for their value as collectibles. In modern times, large gold nuggets are exceedingly rare and are highly valued. “Gold Nuggets at Auction: Stunning Specimens 10k and Above” reveals gold nuggets that have been sold at Heritage Auctions and have sales prices over $10,000.

Contemporary U.S. Specimen Gold

Large gold nuggets are not the only valuable specimens coming out of western mines. Buyers are paying high prices for quality crystalline specimens that are still being mined today. Many examples of these specimens are presented in the article Contemporary U.S. Specimen Gold.

The Top Ten Gold Producing States

These ten states contributed the most to the gold production that built the West from 1848 through the 1930s. Read more at The Top Ten Gold Producing States.

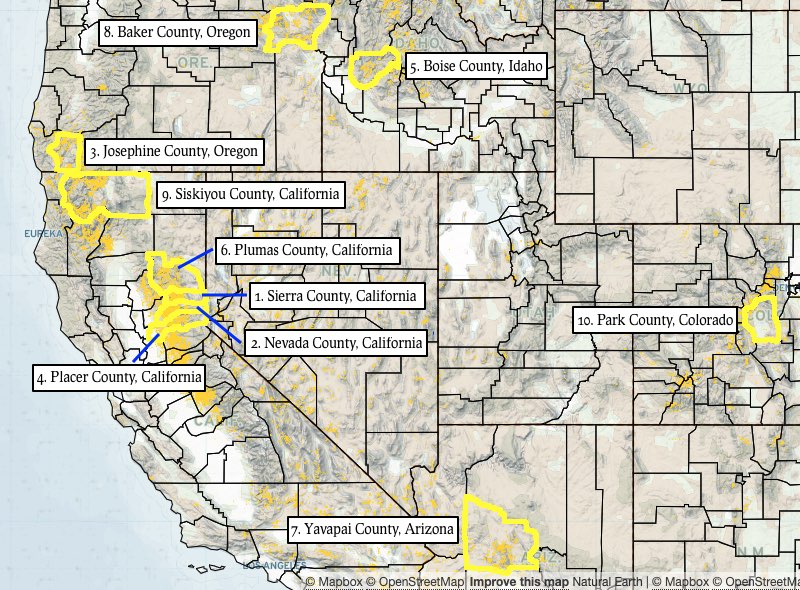

Where To Find Gold: The Top Ten US Counties

By looking at where placer claim density is highest, and where those placer claims correspond with historical gold mine locations, we can determine what US counties have the highest potential for gold discovery. Where To Find Gold: The Top Ten US Counties identifies the top ten counties for placer gold discovery potential.