The Libby Prospect is a gold mine located in Lincoln county, Montana at an elevation of 4,800 feet.

About the MRDS Data:

All mine locations were obtained from the USGS Mineral Resources Data System. The locations and other information in this database have not been verified for accuracy. It should be assumed that all mines are on private property.

Mine Info

Elevation: 4,800 Feet (1,463 Meters)

Commodity: Gold

Lat, Long: 48.0433, -115.55110

Map: View on Google Maps

Libby Prospect MRDS details

Site Name

Primary: Libby Prospect

Commodity

Primary: Gold

Location

State: Montana

County: Lincoln

Land Status

Land ownership: National Forest

Note: the land ownership field only identifies whether the area the mine is in is generally on public lands like Forest Service or BLM land, or if it is in an area that is generally private property. It does not definitively identify property status, nor does it indicate claim status or whether an area is open to prospecting. Always respect private property.

Holdings

Not available

Workings

Not available

Ownership

Not available

Production

Not available

Deposit

Record Type: Site

Operation Category: Unknown

Deposit Type: Unclassified

Operation Type: Underground

Mining Method: Unknown

Years of Production:

Organization:

Significant: Y

Physiography

General Physiographic Area: Rocky Mountain System

Physiographic Province: Northern Rocky Mountains

Mineral Deposit Model

Not available

Orebody

Not available

Structure

Not available

Alterations

Not available

Rocks

Not available

Analytical Data

Not available

Materials

Not available

Comments

Comment (Ownership): In April 2006, Antofagasta and Barrick held 95.97% of Tethyan and was proceeding with the compulsory acquisition of the remaining shares in Tethyan. (Antofagasta PR 4/28/06) In mid-March 2006, Barrick Gold completed its acquisition of Placer Dome. (Barrick PR 3/15/06) In October 2005, Barrick Gold announced an unsolicited $9.2 billion cash and share offer for Placer Dome Inc. The offer represented a premium of 24% over Placer Dome's NYSE closing price on October 28, and 27% on the average closing price over the previous ten days. Placer Dome's common shareholders can elect to receive $20.50 in cash or 0.7518 of a Barrick Gold common share plus $0.05 in cash for each Placer Dome common share, subject to the maximum amount of cash and Barrick common shares offered. Barrick Gold will pay a maximum of about $1.224 billion in cash and about 303 million Barrick common shares, which will result in $2.65 in cash and 0.6562 of a Barrick common share for each Placer Dome common share subject to the offer. (Barrick PR 10/31/05) On December 2, 2004 Barrick Gold announced an agrement to invest in Celtic Resources as part of Barrick's strategy to develop gold assets in the Russian Republic of Sakha (Yakutia) and Kazakhstan. Barrick agreed to spend $28 million and receive about 3.7 million Celtic ordinary shares and 1.84 million Celtic ordinary share purcahse warrants. The warrants had an exercise price of $7.652/share, and an expiry date of December 31, 2007. The deal closed on January 7, 2005, and now Barrick owns about 8.9% of Celtic's increased share capital, with an option to increase its ownership to about 13.4% (an additional 4.5%) through the exercise of warrants. (GAS 2/05) In January 2004, Barrick announced that it was spending $40 million to increase its stake in Highland Gold Mining. Barrick was set to acquire 9.3 million Highland shares at about $4.30/share to raise its stake in Highland from 10% to about 17%. The transaction would give Barrick the right to nominate one director to Highland's board and to assign personnel to the company. Under the deal, Barrick will have the right to participate on an exclusive basis for up to 50% on any acquisition made by Highland in Russia. It also extends similiar rights to Highland for any acquisition made by Barrick in certain regions of Russia, excluding Irkutsk. (GAS 2/04) In December 2001, Barrick completed of its merger with Homestake Mining. (Barrick PR 12/14/01) In June 2001, Barrick Gold Corp said that it would buy Homestake Mining Co in a $2.3 billion share exchange that it said would create the world's second biggest gold miner. Under the terms of the deal Barrick is offering 0.53 of a Barrick share for each of Homestake's 263.3 million outstanding shares, valuing each Homestake share at $8.71. The deal was scheduled to close in the December 2001 quarter. (Reuters 6/25/01) In August 2000, Barrick acquired 22% (1.15 million shares) of IMA Resources for C$1.7 million. (IMA PR 8/16/00) In June 2000, Barrick reported a friendly cash bid to purchase Pangea Goldfields's 29.2 million outstanding shares at a price of C$7.00/share. The transaction valued Pangea at C$204 million. (NM 7/16/00) By September 2000, Barrick had acquired 100% of Pangea. (DC 9/1/00) By July 1999, Barrick had completed its acquisition of Sutton. (DC 7/99) Barrick offered 0.463 Barrick shares for each Sutton share, an exchange that valued Sutton at about C$13.5/share. The total acquisition price was C$525 million. (Barrick PR 2/18/99) In February 1999, Opawica announced that Barrick Gold agreed to subscribe for 1 million units of the company at $1.00/unit, for proceeds to Opawica of C$1 million. Each unit consisted of one common share and one common share purchase warrant. Each warrant entitled Barrick to purchase one common share of the company at $1.25/share. Warrants had a two-year term. (Opawica PR 2/12/99)

Comment (Ownership): By October 1996, Barrick Gold had completed its acquisition of Arequipa Resources. (CMH 1998/99) In July 1996, Barrick Gold made a C$915 million cash takeover bid for Arequipa Resources. (G&M 7/12/96) In December 1995, Barrick acquired 100% of High Desert Mineral Resources from P Lee Halavais and Ronald Halavais. (Barrick PR 2/29/96) Barrick Gold acquired Lac Minerals in 1994. (Barrick Gold 12/94 AR 2/25/95)

References

Reference (Deposit): USGS BULL. 956, 1948 P.95

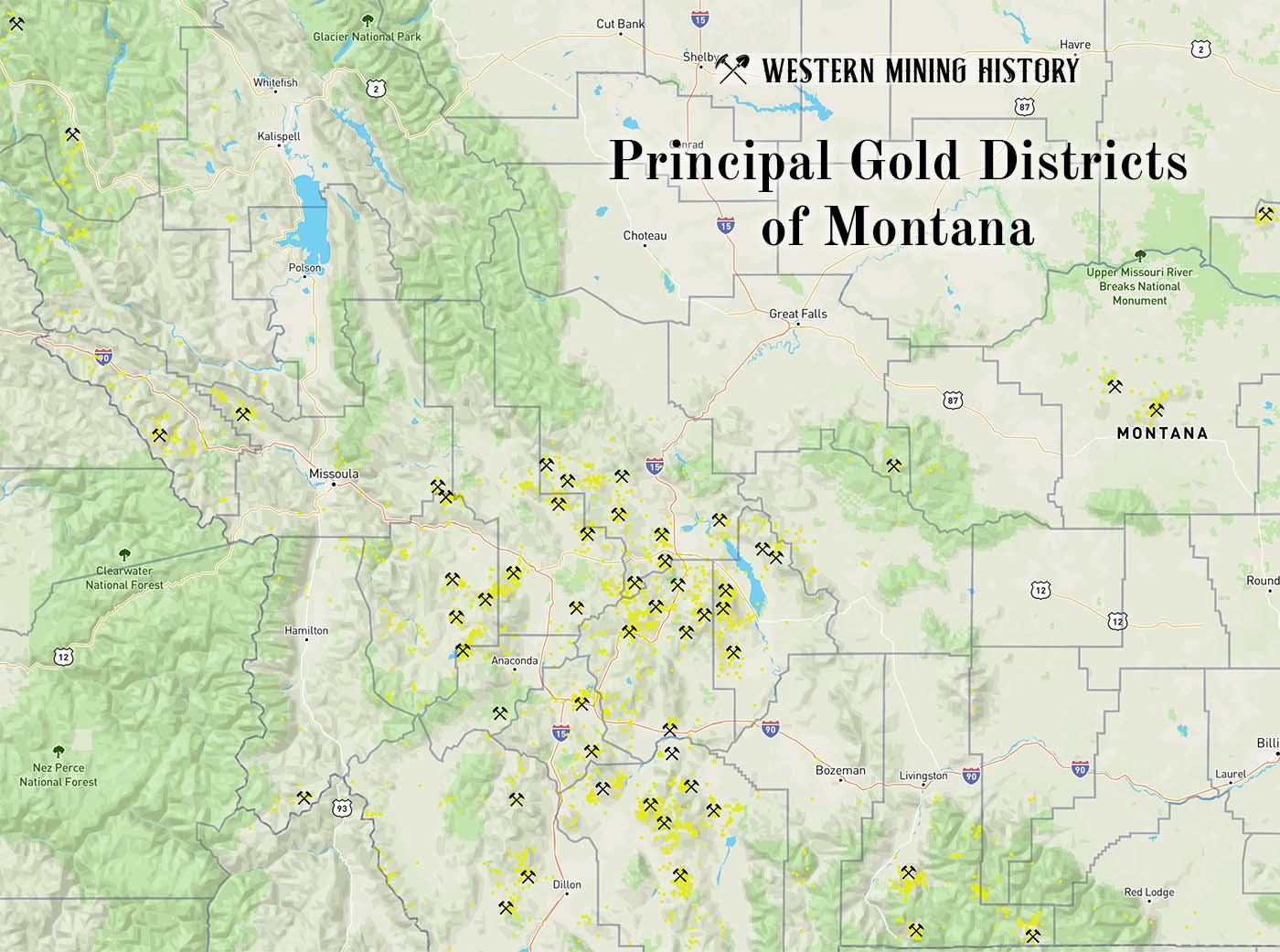

Principal Gold Districts of Montana

In Montana, 54 mining districts have each have produced more than 10,000 ounces of gold. The largest producers are Butte, Helena, Marysville, and Virginia City, each having produced more than one million ounces. Twenty seven other districts are each credited with between 100,000 and one million ounces of gold production. Read more: Principal Gold Districts of Montana.