The Montana Tunnels/Diamond Hill is a silver, lead, gold, and zinc mine located in Jefferson county, Montana at an elevation of 5,577 feet.

About the MRDS Data:

All mine locations were obtained from the USGS Mineral Resources Data System. The locations and other information in this database have not been verified for accuracy. It should be assumed that all mines are on private property.

Mine Info

Elevation: 5,577 Feet (1,700 Meters)

Commodity: Silver, Lead, Gold, Zinc

Lat, Long: 46.3722, -112.13330

Map: View on Google Maps

Satelite View

MRDS mine locations are often very general, and in some cases are incorrect. Some mine remains have been covered or removed by modern industrial activity or by development of things like housing. The satellite view offers a quick glimpse as to whether the MRDS location corresponds to visible mine remains.

Montana Tunnels/Diamond Hill MRDS details

Site Name

Primary: Montana Tunnels/Diamond Hill

Secondary: Montana Tunnels Project

Secondary: Montana Tunnels

Commodity

Primary: Silver

Primary: Lead

Primary: Gold

Primary: Zinc

Location

State: Montana

County: Jefferson

District: Wickes

Land Status

Land ownership: Unknown

Note: the land ownership field only identifies whether the area the mine is in is generally on public lands like Forest Service or BLM land, or if it is in an area that is generally private property. It does not definitively identify property status, nor does it indicate claim status or whether an area is open to prospecting. Always respect private property.

Holdings

Type: Private Lease

Type: Fee Ownership

Type: Located Claim

Workings

Type: Surface

Ownership

Owner Name: Montana Tunnels Mining, Inc.

Home Office: Montana

Info Year: 1996

Owner Name: Pegasus Gold Inc.

Company ID: 2401769

Percent: 100.0

Home Office: Washington

Info Year: 1996

Production

Year: 1996

Description: Silver Production 921500 T Oz/Yr Silver

Year: 1996

Description: Gold Production (Includes Diamond Hill) 81600 T Oz/Tr Gold

Year: 1995

Description: Silver Production 1073200 T Oz/Yr Silver

Year: 1995

Description: Gold Production 89200 T Oz/Yr Gold

Year: 1994

Description: Silver Production 1085700 T Oz/Yr

Year: 1994

Description: Gold Production 80200 T Oz/Yr

Year: 1993

Description: Silver Production 1401100 T Oz/Yr

Year: 1993

Description: Gold Production 68900 T Oa/Yr

Year: 1992

Description: Silver Prodrction 1325700 T Oz/Yr

Year: 1992

Description: Gold Production 74700 T Oz/Yr

Year: 1991

Description: Silver Production 1166300 T Oz/Yr

Year: 1991

Description: Gold Production 62600 T Oz/Yr

Deposit

Record Type: Site

Operation Category: Plant

Deposit Type: Diatreme, polymetallic, disseminated, Au-bearing

Plant Type: Leach

Operation Type: Surface-Underground

Mining Method: Open Pit

Milling Method: Flotation

Year First Production: 1987

Discovery Year: 1981

Years of Production:

Organization:

Significant: Y

Deposit Size: M

Physiography

General Physiographic Area: Rocky Mountain System

Physiographic Province: Northern Rocky Mountains

Mineral Deposit Model

Model Name: Alkaline Au-Te (Au-Ag-Te veins)

Orebody

Form: PIPE-LIKE

Structure

Type: L

Structure: FAULT CONTACT

Type: R

Structure: LARGE ROOF PENDANT

Alterations

Alteration Type: L

Alteration: PERVASIVE SERICITIC

Rocks

Name: Granodiorite

Role: Associated

Description: GRANODIORITE; QUARTZ LATITE PORPHYRY DIKES (LCV)

Age Type: Associated Rock Unit

Age Young: Late Cretaceous

Name: Andesite

Role: Host

Description: ANDESITIC VOLCANICLASTIC ROCKS

Age Type: Host Rock Unit

Age Young: Cretaceous

Analytical Data

Not available

Materials

Ore: Proustite

Ore: Pyrargyrite

Ore: Sphalerite

Ore: Pyrite

Ore: Galena

Ore: Electrum

Ore: Chalcopyrite

Comments

Comment (Deposit): DEPOSIT IS ALSO IN SECTIONS 5, 7, 8 AND 9 T7N, R4W.

Comment (Production): PRODUCT RECORD A INCLUDES ALL MILL COSTS FOR ALL PRODUCTS. GOLD AND SILVER (PRODUCTS A AND B) ARE COMBINED AS DORE PRODUCT. BOTH ARE PRODUCTS OF LEACH PORTION OF CIRCUIT.

Comment (Geology): OREBODY IS CONTAINED WITHIN DIATREME PIPE.

Comment (Ownership): USMX RECEIVES A 5% NSR OR $60,000 MIN TILL PAYBACK THAN 50% NSR AFTER PAYBACK.

Comment (Reserve-Resource): REFERENCES 134 & 135 HAVE RESERVE/RESOURCES DATA: HOWEVER DATA COULD NOT BE SUPPORTED BY AVAILABLE ANNUAL & FROM 10-K REPORT DATA.

Comment (Production): GOLD AND SILVER YIELDS ARE IN DORE OF UNKNOWN COMPOSITION. . ESTIMATED DORE ASSAY IS: 5.5 PERCENT GOLD AND 89.2 PERCENT SILVER. ASSUMING COMBINED GOLD/SILVER IS ABOUT 95 PERCENT. OF TOTAL COMBINED METALS IN DORE. .

Comment (Production): 1988 AU PROD.= 106,000 OZ.; 1989 AU PROD.= 57,242 OZ. 1991-1996 PRODUCTION INCLUDES DIAMOND HILL:

Comment (Geology): DEPOSIT IS IN CENTRAL PART OF A DIATREME BRECCIA THAT WAS EMPLACED ALONG THE FAULTED CONTACT BETWEEN ANDESITIC VOLCANICS AND A SEQUENCE OF QUARTZ LATITIC IGNIMBRITES. PRINCIPAL ROCK TYPE IN THE DIATREME IS A MATRIX-RICH BRECCIA. ALTERATION IS SERICITIC IN NATURE.

Comment (Reserve-Resource): TOTAL PROVEN + PROBABLE ORE; 12/31/96: NO MINERALIZED MATERIAL PRODUCTION BASED ON AVG OF 1992-1996 ORE MILLED:

Comment (Reserve-Resource): GOLD ASSAY IS EQUIVALENT VALUE AND INCLUDES SILVER, ZINC, AND LEAD VALUES: M1C1 JAN. 1987 BOM DEMONSTRATED RESOURCE: 1,113,460 OZ GOLD, M1C2. MAT 2 COL 1 REPRESENTS MINABLE RESOURCE; MAT 2 COL 2 REPRESENTS THE TOTAL RESOURCE AVAILABLE.

Comment (Exploration): UNDERGROUND MINING BEGAN IN 1864 AND FLOURISHED UNTIL THE EARLY 1900'S. ; ECON.COM: AU RECOVERY AVERAGES 88%, AG RECOVERY AVERAGES 75%. UNIT COSTS WERE $8.61 PER TON IN LATE 1991. CASH COSTS PER OUNCE OF AU NET OF BYPRODUCT WERE $21 IN 1990 AND $121 IN 1991, THE INCREASE ATTRIBUTABLE TO SHARPLY LOWER ZN PRICES. MINING RATE WAS 12,500 ST/DAY IN 1988. MINE LIFE EXPECTED TO BE 12 YRS (OR 15 YRS. IF LOW GRADE ORE IS RECOVERED), BASED ON 1988 RESERVES. TOTAL MINESITE WORKFORCE, INCLUDING THE MINING CONTRACTOR, IS 174 PERSONNEL WITH AN ANNUAL PAYROLL OF APPROXIMATELY $7.5 MILLION. IN 1990 THE MINE PURCHASED OVER $7.7 MILLION WORTH OF GOODS AND SERVICES FROM THE LOCAL AREA AND PAID $1.6 MILLION IN PROPERTY AND MINING TAXES TO STATE, COUNTY, AND LOCAL GOVERNMENTS. 1975-1983- AREA TARGET OF AT LEAST SIX EXPLORATION COMPANIES AND ALL DROPPED THE PROPERTY. 1983-84- CENTENNIAL MINERALS LTD. (WITH USMX, THE OWNER OF THE PROPERTY) COMPLETED EXPLORATION PROGRAM. USMX IS THE US MINERALS EXPLORATION COMPANY. DECEMBER 1984-OPERATING PERMIT APPLICATION SUBMITTED TO MDSL. LATE 1985-DRAFT EIS COMPLETED. SEPTEMBER 1985-PEGASUS OFFERS TO ACQUIRE SHARES OF CENTENNIAL MINERALS LTD. NOVEMBER 1985-PEGASUS (THROUGH ITS SUBSIDIARY, CENTENNIAL MINERALS LTD) PROCEEDS WITH DEVELOPMENT FEBRUARY 1986-EIS FINALIZED; OPERATING PERMIT GRANTED MARCH, 1986-CONSTRUCTION STARTS 1987-PEGASUS ACQUIRES 100% WORKING INTEREST FROM USMX MARCH 1987- MILL START-UP JANUARY 16,1998- PEGASUS GOLD INC. FILES FOR PROTECTION UNDER CHAPTER 11.

Comment (Geology): THE DIATREME WHICH HOSTS MINERALIZATION WAS EMPLACED ALONG THE FAULTED CONTACT BETWEEN ANDESITIC VOLCANICLASTIC ROCKS, ASSIGNED TO THE LATE CRETACEOUS ELKHORN MOUNTAINS VOLCANICS, AND A SEQUENCE OF QUARTZ LATITIC IGNIMBRITES, WHICH ARE PART OF THE LOWLAND CREEK VOLCANICS OF MIDDLE EOCENE AGE.

Comment (Geology): FAULT CONTACT BETWEEN THE MIDDLE EOCENE LOWLAND CREEK VOLCANICS AND THE LATE CRETACEOUS ELKHORN MOUNTAINS VOLCANICS. THE DIATREME IS SEPARATED INTO TWO UNEQUAL PARTS BY A WEST-NORTHWEST-STRIKING OBLIQUE SLIP FAULT. IT HAS A MAXIMUM SINISTRAL OFFSET OF ABOUT 180 M (SILLITOE AND OTHERS, 1985). THE DIATREME APPEARS TO CUT, AND IS THOUGHT TO HAVE BEEN LOCALIZED BY, A GRABEN FAULT THAT DELIMITS THE WESTERN EDGE OF THE LOWLAND CREEK VOLCANICS (SILLITOE AND OTHERS, 1985). ALSO, MINOR FAULTS, MARKED BY UP TO 1 CM OF DARK GRAY GOUGE, ARE WIDESPREAD IN THE DIATREME BRECCIA AND AT LEAST SOME OF THEM APPEAR TO BE PRODUCTS OF DIFFERENTIAL SUBSIDENCE WITHIN THE DIATREME RATHER THAN RESPONSES TO REGIONAL TECTONISM. (SILLITOE AND OTHERS, 1985).

Comment (Geology): THE PRINCIPAL ROCK TYPE OF THE DIATREME IS A MATRIX-RICH BRECCIA. CLASTIC GRAINS OF THE SULFIDES AND GANGUE MINERALS ARE COMMON AND ATTEST TO MULTIPLE ALTERNATING EPISODES OF BRECCIATION AND MINERALIZATION. 70 TO 90% OF THE ORE AND GANGUE MINERALS OCCUR AS DISSEMINATIONS AND THE REMAINER IN CROSSCUTTING VEINLETS. (SILLITOE AND OTHERS, 1985).

Comment (Workings): HISTORIC UNDERGROUND WORKINGS CONSISTED OF 2 CAVED ADITS CONNECTED BY A WINZE 35 FT. DEEP. THE OPEN PIT MINE MOVES AN AVERAGE OF 70,000 TONS PER DAY OF ORE AND WASTE. THE ORE IS TREATED BY CRUSHING, THEN AUTOGENOUS AND BALL MILL GRINDING FOLLOWED BY SEQUNTIAL PB-ZN FLOTATION. PB AND ZN CONCENTRATES, CONTAINING THE PRECIOUS METALS, ARE CLEANED IN FURTHER FLOTATION STEPS AND SHIPPED TO REFINERIES BY TRUCK AND/OR RAIL. THE PB CONCENTRATE IS DELIVERED TO ASARCO'S EAST HELENA SMELTER, 20 MILES FROM THE MINE. THE ZN CONCENTRATE IS TRUCKED TO THE COMPANY'S RAIL LOADING FACILITY IN HELENA, WHERE IT IS LOADED ON RAILCARS TO COMINCO'S TRAIL SMELTER IN BRITISH COLUMBIA OR TO THE DOWA SMELTER IN JAPAN. THE PRESENT OPERATION COVERS 817 ACRES WITHIN A "PERMITTED" ACREAGE OF 1500 ACRES. THE ENTIRE MINING AND MILLING OPERATION IS ON PRIVATE LAND; NO STATE OR FEDERAL LANDS ARE INVOLVED.

Comment (Deposit): SELECTION OF USGS MODEL TYPE BASED ON COMPARISON MADE TO CRIPPLE CREEK, COLORADO (SILLITOE ET AL, 1985). THE DEPOSIT IS A VERTICAL PIPE-LIKE STRUCTURE APPROXIMATELY 800 FT. BY 1000 FT. IN PLAN AND AT LEAST 2000 FT. IN DEPTH.

Comment (Development): UNDERGROUND MINING BEGAN IN 1864 AND FLOURISHED UNTIL THE EARLY 1900'S. ; ECON.COM: AU RECOVERY AVERAGES 88%, AG RECOVERY AVERAGES 75%. UNIT COSTS WERE $8.61 PER TON IN LATE 1991. CASH COSTS PER OUNCE OF AU NET OF BYPRODUCT WERE $21 IN 1990 AND $121 IN 1991, THE INCREASE ATTRIBUTABLE TO SHARPLY LOWER ZN PRICES. MINING RATE WAS 12,500 ST/DAY IN 1988. MINE LIFE EXPECTED TO BE 12 YRS (OR 15 YRS. IF LOW GRADE ORE IS RECOVERED), BASED ON 1988 RESERVES. TOTAL MINESITE WORKFORCE, INCLUDING THE MINING CONTRACTOR, IS 174 PERSONNEL WITH AN ANNUAL PAYROLL OF APPROXIMATELY $7.5 MILLION. IN 1990 THE MINE PURCHASED OVER $7.7 MILLION WORTH OF GOODS AND SERVICES FROM THE LOCAL AREA AND PAID $1.6 MILLION IN PROPERTY AND MINING TAXES TO STATE, COUNTY, AND LOCAL GOVERNMENTS. ; MILL.CAP : 4 MILLION TONS/YEAR

Comment (Commodity): SULFIDE MINERALS OCCUR AS DISSEMINATIONS IN THE BRECCIA MATRIX AND, TO A LESSER EXTENT, AS WIDELY SPACED MULTIDIRECTIONAL VEINLETS AND AS MATRIX TO BRECCIATED BLOCKS OF ELKHORN MOUNTAIN VOLCANICS. AU OCCURS IN ELECTRUM, WITH A FINENESS OF APPROXIMATELY 550 AND AS INCLUSIONS OF <200 MICRONS IN PYRITE AND SPHALERITE. AG IS PRESENT MAINLY IN SOLID SOLUTION IN GALENA. AU-AG MINERALIZATION DECREASES SIGNIFICANTLY AT AN APPROXIMATE DEPTH OF 1000 FT., WHILE PB AND ZN VALUES CONTINUE TO A DEPTH OF AT LEAST 2000 FT. MN VALUES ARE HIGH WHILE HG, AS, AND SB VALUES ARE LOW COMPARED TO MANY VOLCANIC-HOSTED PRECIOUS METAL DEPOSITS.

Comment (Production): FROM 1987 TO 12/31/91: 18.5 MILLION TONS OF ORE ASSAYED 0.020 OPT AU, 0.46 OPT AG, 0.26% PB, AND 0.71% ZN. PRODUCTION NUMBERS FROM PEGASUS ANNUAL REPORTS AND MINE INFORMATION PACKETS: 1988-73,971 OZ AU, 975,463 OZ AG, 8,250 TONS PB, 19,350 TONS ZN 1991-62,600 OZ AU, 1,167,000 OZ AG, 7,200 TONS PB, 18,300 TONS ZN FROM 3,870,000 TONNES 1992-74,700 OZ AU, 1,325,700 OZ AG, 7,200 TONS PB, 19,400 TONS ZN FROM 4,150,000 TONNES 1993-68,900 OZ AU, 1,401,100 OZ AG, 7,000 TONS PB, 18,000 TONS ZN FROM 4,170,000 TONNES 1994 - 80,200 OZ AU, 1,085,700 OZ AG, 9,400 TONS PB, 19,800 TONS ZN FROM 4,720,000 TONNES 1995 - 89,200 OZ AU, 1,073,200 OZ AG, 7,400 TONS PB, 21,600 TONS ZN FROM 5,10,000 TONNES 1996 - 73,000 OZ AU, 916,400 OZ AG, 7,000 TONS PB, 18,300 TONS ZN FROM 4,961,000 TONNES 1997- 78,500 OZ AU, 785,400 OZ AG; 8,493 TONS PB; 20,861 TONS ZN; FROM 4,668,000 TONNES 1998-70,000 OZ AU 1999-75,000 OZ AU GOLD RESERVES AS OF DECEMBER 31, 1997 CALCULATED AT $350/OZ GOLD: PROVEN AND PROBABLE - 17,589,000 TONNES @ 0.55 GRAMS/TONNE WITH 308,000 CONTAINED OUNCES. MINERALIZED MATERIAL - 18,603,000 TONNES @ 0.57 GRAMS/TONNE WITH 343,000 CONTAINED OUNCES. ADDITIONAL MINERALIZATION - 14,043 TONNES @ 0.52 GRAMS/TONNE WITH 233,000 CONTAINED OUNCES. MILL USES CRUSHING, SEMI-AUTOGENOUS AND BALL MILL GRINDING, AND BULK FLOTATION TO PRODUCE A SULFIDE CONCENTRATE. THE CONCENTRATE IS REGROUND, FILTERED AND THE GOLD AND SILVER DISSOLVED DURING AN AGITATED CYANIDE LEACH. GOLD AND SILVER ARE RECOVERED IN THE MERRILL CROWE PROCESS WITH LEAD AND ZINC CONCENTRATES PRODUCED BY DIFFERENTIAL FLOTATION..

References

Reference (Geology): Sillitoe R H, Grauberger G L, Elliott J E 1985 - A diatreme-hosted Gold deposit at Montana tunnels, Montana: in Econ. Geol. v80 1707-1721

Reference (Deposit): MONTANA DEPARTMENT OF STATE LANDS. MONTANA TUNNELS PROJECT - DRAFT ENVIRONMENTAL IMPACT STATEMENT. HELENA, MT .NOV., 1985.

Reference (Reserve-Resource): PEGASUS GOLD INC., 1995 ANNUAL REPORT, PP. 6-7 & FORM 10-K REPORT, PP. 9, 17.

Reference (Reserve-Resource): MAT 1 COL'S 1 & 2 FROM U.S.M.X. 1996 ANNUAL REPORT.

Reference (Reserve-Resource): MONTANA BUREAU OF MINES AND GEOLOGY, BUL. #129, 1991.

Reference (Production): PEGASUS GOLD INC., 1996 FORM 10-K REPORT, P12.

Reference (Production): PEGASUS GOLD INC., 1995 FORM 10-K REPORT, P17.

Reference (Deposit): SPOKESMAN REVIEW. PEGASUS GOLD AWARDS MILL PROJECT, CONTRACT. MAY 30, 1986.

Reference (Deposit): GEOLOGY MAGAZINE, VOL. 80, 1985, P. 1707-1721.

Reference (Deposit): SKILLINGS MINING REVIEW. USMX/PEGASUS GOLD INC.'S MONTANA TUNNELS PROJECT - OVERVIEW AND UPDATE. DEC. 6, 1986 P. 4.

Reference (Deposit): PEGASUS GOLD INC., 1991 ANNUAL REPORT, P 4- 5, 9-10.

Reference (Deposit): USMX, INC. NEWS RELEASE. "USMX, INC. IN AGREEMENT TO SELL INTEREST IN MONTANA TUNNELS MINE TO PEGASUS GOLD CORPORATION, 6/25/96.

Reference (Deposit): WALLACE MINER. MONTANA TUNNELS TO USE HELENA SMELTER. DEC. 4, 1986, P.1.

Reference (Deposit): U.S.M.X. 1986 ANNUAL REPORT.

Reference (Deposit): WRIGHT ENGINEERS LTD. FEASIBILITY STUDY-MONTANA TUNNELS PROJECT. VANCOUVER, CANDADA. OCT., 1985.

Reference (Deposit): HOSTED GOLD DEPOSIT AT MONTANA TUNNELS, MONTANA. ECONOMIC GEOLOGY MAGAZINE, VOL. 80, 1985, P. 1707-1721.

Reference (Deposit): U.S. MINERALS EXPLORATION COMPANY. ANNUAL REPORT. 1986,

Reference (Deposit): SILLITOE, R., GRAUBERGER, G AND ELLIOTT, J. A DIATREME HOSTED GOLD DEPOSIT AT MONTANA TUNNELS, MONTANA. ECONOMIC GEOLOGY MAGAZINE, VOL. 80, 1985, P. 1707-1721.

Reference (Deposit): SPOKANE, WA., APRIL, 1985.

Reference (Deposit): NORTHWEST MINING ASSOCIATION METALS AND MINERALS CONFERENCE. SPOKANE, WA., APRIL, 1985.

Reference (Deposit): TUNNELS OREBODY, MONTANA: A DIATREME-HOSTED GOLD DEPOSIT. NORTHWEST MINING ASSOCIATION METALS AND MINERALS CONFERENCE. SPOKANE, WA., APRIL, 1985.

Reference (Deposit): SILLITOE, R., GEOLOGY AND GEOCHEMISTRY OF THE MONTANA TUNNELS OREBODY, MONTANA: A DIATREME-HOSTED GOLD DEPOSIT. NORTHWEST MINING ASSOCIATION METALS AND MINERALS CONFERENCE. SPOKANE, WA., APRIL, 1985.

Reference (Deposit): NOV., 1985.

Reference (Deposit): PROJECT - DRAFT ENVIRONMENTAL IMPACT STATEMENT. HELENA, MT .NOV., 1985.

Reference (Deposit): RANDOL MINING DIRECTORY, 1996/97, U.S. MINES AND MINING COMPANIES, P220.

Reference (Deposit): THE MINING RECORD, VOL 107, #49, 12/04/96, PP. 8, 9.

Reference (Deposit): THE MINING RECORD, VOL 107, #34, AUG., 21, 1996, P19.

Reference (Deposit): 26. AMERICAN CYANIMID COMPANY. 1986, 178 P.

Reference (Deposit): MINING CHEMICALS HANDBOOK. MINERAL DRESSING NOTES NO. 26. AMERICAN CYANIMID COMPANY. 1986, 178 P.

Reference (Deposit): MAY, 1986, P. 8.

Reference (Reserve-Resource): PEGASUS GOLD INC., 1996 ANNUAL REPORT, PP. 6-7 & FORM 10-K REPORT, PP. 12-13.

Reference (Deposit): ENGINEERING AND MINING JOURNAL. MINING ACTIVITY DIGEST. MAY, 1986, P. 8.

Reference (Geology): USGS PROFESSIONAL PAPER 428., P.81, PLATE 1.

Reference (Geology): USGS BULLETIN 527, P. 116.

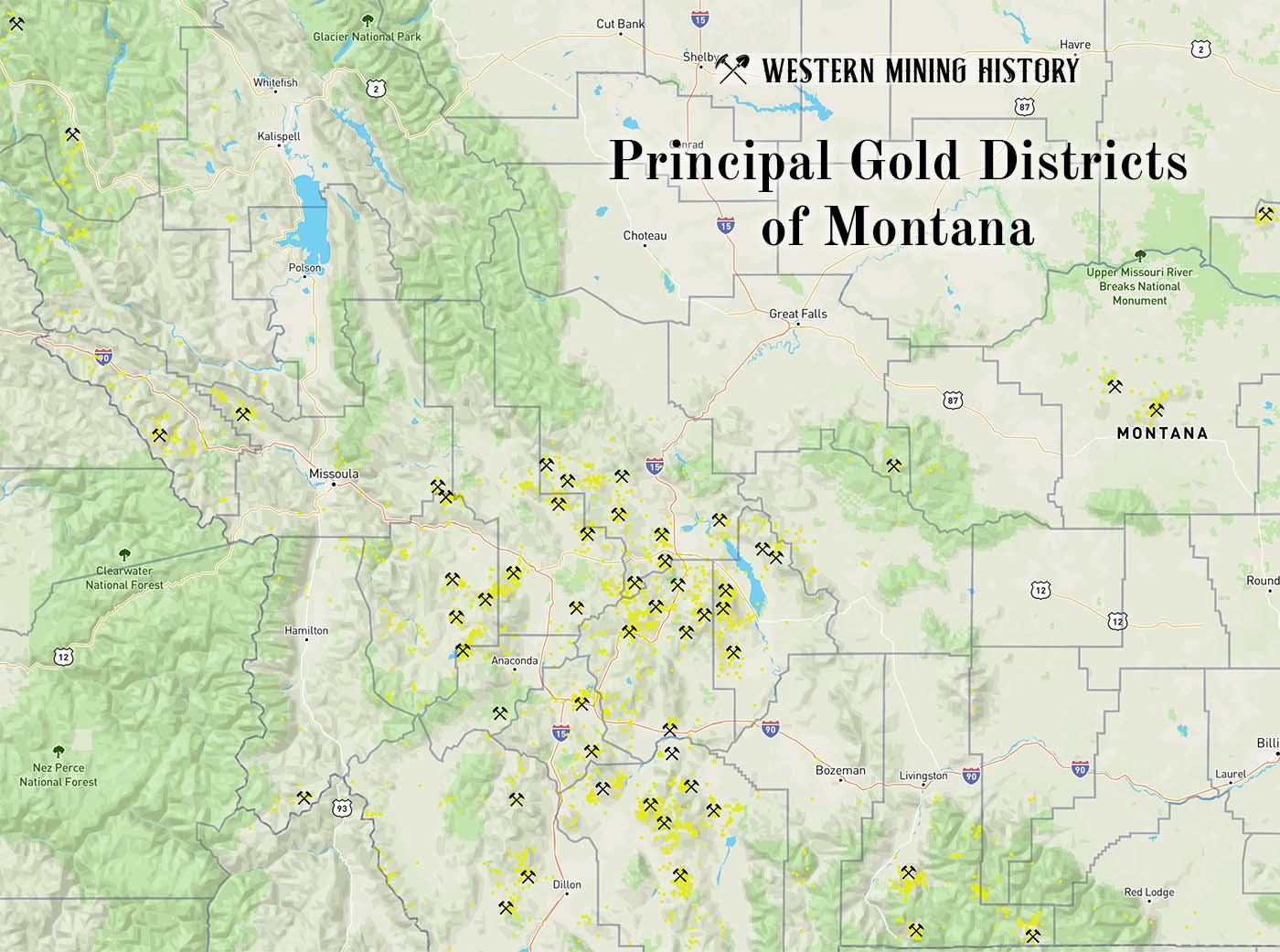

Principal Gold Districts of Montana

In Montana, 54 mining districts have each have produced more than 10,000 ounces of gold. The largest producers are Butte, Helena, Marysville, and Virginia City, each having produced more than one million ounces. Twenty seven other districts are each credited with between 100,000 and one million ounces of gold production. Read more: Principal Gold Districts of Montana.